E-Commerce Strategies

Dec 25, 2025

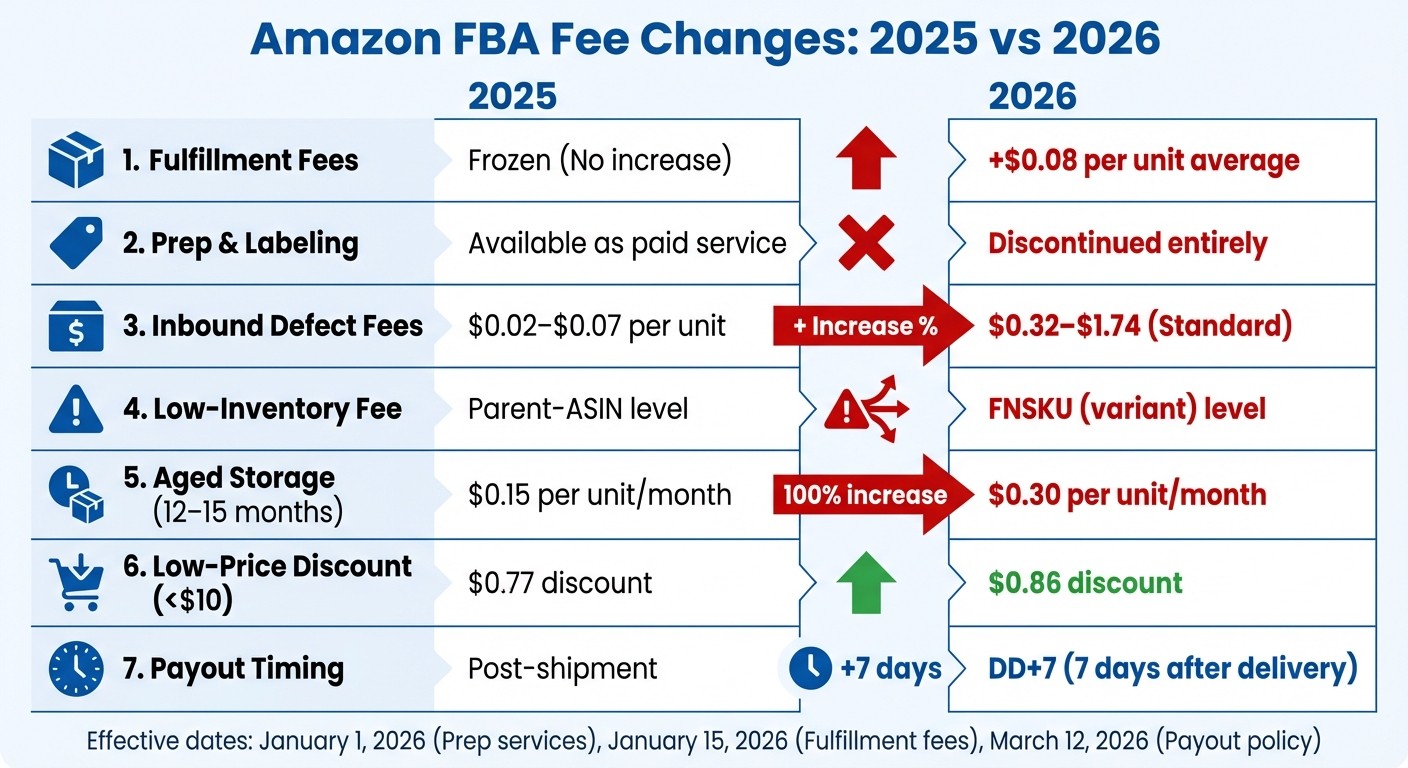

Amazon is making big changes to its FBA fee structure in 2026, and sellers need to prepare. Starting January 15, 2026, fulfillment fees will increase by an average of $0.08 per unit, while aged inventory fees, inbound defect fees, and low-inventory penalties are set to rise significantly. Additionally, Amazon will discontinue its U.S. FBA prep and labeling services on January 1, 2026, leaving sellers responsible for ensuring products meet FBA requirements. A new DD+7 payout policy will also delay payments by 7 days starting March 12, 2026. These changes will tighten profit margins, so sellers must reassess their pricing, inventory, and fulfillment strategies now.

Key updates include:

Fulfillment fees: Average increase of $0.08 per unit.

Prep and labeling services: Discontinued starting January 1, 2026.

Inbound defect fees: Jumping to $0.32–$1.74 per unit (from $0.02–$0.07).

Aged inventory fees: Doubling for items stored 12–15 months.

Low-inventory fees: Now tracked at the FNSKU (variant) level.

Payout delays: Payments delayed by 7 days after delivery starting March 12, 2026.

These changes demand careful planning to maintain profitability. Focus on optimizing inventory, managing prep tasks, and building cash reserves to handle the delayed payouts.

1. Amazon FBA Fees in 2025

Fulfillment Fees

In 2025, Amazon kept its standard fulfillment fees steady, giving sellers some breathing room for financial planning. For a small standard item (weighing ≤2 oz), the cost remained at $3.06, while shipping a large standard item between 1 and 1.25 pounds was priced at $4.99. For items over 3 pounds, the fee was $6.92, with an additional $0.08 for every 4 ounces beyond that weight.

This fee stability was a relief for sellers, especially since it meant no unexpected mid-year changes. According to Dharmesh Mehta, Amazon’s Vice President of Worldwide Selling Partner Services, sellers were paying, on average, $0.05 less per unit compared to the previous year. However, it’s important to note that this freeze applied only to core fulfillment and referral fees. Other secondary charges saw increases throughout the year, and storage fees were another area where changes came into play.

Storage Fees

While fulfillment fees stayed the same, storage fees told a different story. For most of the year (January through September), the monthly storage rate for standard-size items held steady at $0.78 per cubic foot. However, during Q4, when holiday sales ramped up, storage fees jumped from $2.40 to $2.70 per cubic foot - a 12.5% increase that directly impacted sellers during the busiest season.

Surcharges on aged inventory also saw a sharp rise. Items stored for over 365 days faced fees nearly doubling, going from $3.60 to $6.90 per cubic foot. Even inventory stored for 271–365 days wasn’t spared, with fees increasing from $2.40 to $3.80 per cubic foot. Ken Zhou, COO of My Amazon Guy, highlighted this shift, stating:

"The 'freeze' mainly applied to a handful of core fees... But at the same time, Amazon rolled out new charges and adjusted policies that quietly increased seller costs elsewhere."

Low-Price Program

The Low-Price FBA program offered a welcome break for sellers dealing in items priced under $10. Products in this category enjoyed a $0.77 discount per unit compared to standard FBA rates throughout the year. For example, a small standard item (≤2 oz) was reduced from $3.06 to $2.29, while a large standard item (≤4 oz) dropped from $3.68 to $2.91.

Starting January 15, 2025, Amazon removed peak fees for these items, applying non-peak rates year-round. This change helped sellers maintain better margins on budget-friendly products. The program also introduced the Ships in Product Packaging (SIPP) feature, which provided additional savings ranging from $0.04 to $1.32 per unit for eligible items, making it a valuable option for sellers focused on affordability.

2. Amazon FBA Fees in 2026

Fulfillment Fees

Starting January 15, 2026, Amazon will increase fulfillment fees for the first time since the freeze, with an average rise of $0.08 per unit. While Amazon states this equates to less than 0.5% of an average product's selling price, the actual impact depends heavily on the product's price and size.

For small standard items priced over $50, fees will go up by $0.51 per unit (15.4%), while items in the $10–$50 range will see smaller increases: $0.25 for small standard items and $0.05 for large standard items. Interestingly, large standard items priced under $10 will see no changes in fees.

Another major update involves the Low-Inventory-Level (LIL) fee, which will now apply to individual FNSKU (variant) levels instead of the parent-ASIN level. This means that even if your overall product line has sufficient stock, running low on a specific size or color could trigger surcharges ranging from $0.32 to $2.09 per unit. To avoid these fees, sellers must maintain at least 28 days of supply for every variation. Next, let’s look at the updates to storage fees.

Storage Fees

Here’s a mix of good and bad news: base monthly storage rates remain unchanged for 2026, but aged inventory fees are going up significantly. Items stored for 12–15 months will now cost $0.30 per unit per month, double the 2025 rate. For inventory sitting longer than 15 months, fees jump to $0.35 per unit or $7.90 per cubic foot, whichever is higher.

For sellers using Amazon Warehousing & Distribution (AWD), storage fees in the West region are increasing by 19%, reaching $0.57 per cubic foot. Transportation fees for moving bulk inventory into FBA warehouses via AWD are also climbing by 20–22%. These changes make it more expensive to manage stock, particularly for sellers relying on AWD. Now, let’s explore how the Low-Price Program continues to support budget-conscious sellers.

Low-Price Program

The Low-Price FBA program remains a bright spot for sellers of affordable products. The program now offers a discount of $0.86 per unit, helping to offset a $0.12 base fee increase for small standard items priced under $10. With the Ships in Product Packaging (SIPP) feature, sellers can continue to maintain competitive margins for budget-friendly products.

Profit Margins

These fee adjustments are tightening profit margins, forcing sellers to rethink their operations. Adding to the challenges, Amazon is discontinuing all FBA prep and labeling services in the U.S. starting January 1, 2026. Sellers will need to ensure their products are fully compliant before shipping them to Amazon. Non-compliance will result in steep inbound defect fees ranging from $0.32–$1.74 for standard items and up to $5.72 for bulky products - a huge jump from the 2025 range of $0.02–$0.07. This change will likely push many sellers to partner with third-party logistics (3PL) providers or arrange factory-level prep.

Additionally, starting March 12, 2026, Amazon’s new "DD+7" payout policy will delay payments by seven days. This shift will create cash flow challenges, requiring sellers to have larger reserves to cover inventory costs, prep services, and operating expenses while waiting for their funds to clear.

2026 Amazon Fee Increases Breakdown

Advantages and Disadvantages

Amazon FBA Fee Changes 2025 vs 2026 Comparison

Looking at the fee comparisons outlined earlier, the 2026 changes bring a mix of new opportunities and hurdles for sellers. While 2025 provided a period of fee stability, the adjustments for 2026 demand that sellers weigh the benefits of improved discounts against the reality of higher operational expenses.

On the positive side, the enhanced Low-Price FBA discount - now $0.86 per unit - makes it easier for sellers to stay competitive in the budget-friendly market. Sellers with low return rates also stand to gain from the updated threshold-based returns processing fee, which only applies when returns surpass category benchmarks. Additionally, sellers of extra-large items certified under SIPP will see fulfillment fees drop by an average of $2.08 per unit, offering some relief in this category.

However, the challenges are hard to ignore. Starting January 1, 2026, Amazon will no longer offer its prep and labeling services, forcing sellers to either manage these tasks internally or outsource them to third parties. The inbound defect fees for standard items will also see a steep rise - from $0.02–$0.07 per unit to $0.32–$1.74 - making even minor errors much costlier. Another significant change involves the shift to FNSKU-level low-inventory fees, which means sellers must maintain deeper stock levels for each product variation to avoid penalties ranging from $0.32 to $2.09 per unit. On top of this, the new DD+7 payout policy, effective March 12, 2026, will delay payments by seven days after delivery, potentially straining cash flow for sellers operating on tight margins.

Fee Category | 2025 Structure | 2026 Structure |

|---|---|---|

Fulfillment Fees | Frozen (No increase) | +$0.08 per unit average |

Prep & Labeling | Available as paid service | Discontinued entirely |

Inbound Defect Fees | $0.02–$0.07 per unit | $0.32–$1.74 (Standard) |

Low-Inventory Fee | Parent-ASIN level | FNSKU (variant) level |

Aged Storage (12–15 months) | $0.15 per unit/month | $0.30 per unit/month |

Low-Price Discount (<$10) | $0.77 discount | $0.86 discount |

Payout Timing | Post-shipment | DD+7 (7 days after delivery) |

These changes demand a thoughtful approach to operations and pricing strategies. As Online Seller Solutions aptly put it, "2026 will be less about 'absorbing a price hike' and more about rebuilding your margin model from the ground up." Sellers will need to carefully analyze their processes and adapt to maintain profitability in this evolving landscape.

Conclusion

The transition from 2025 to 2026 brings more than just a slight fee adjustment - it represents a major shift in how sellers will need to operate. While 2025 provided some stability with frozen rates, 2026 introduces what Amazon refers to as "pricing precision", which includes an average fee increase of $0.08 per unit and potential penalties tied to seller behavior. Adding to the challenge, Amazon is ending its FBA prep and labeling services on January 1, 2026, and introducing steep fee hikes for inbound defects. Sellers will need to rethink their fulfillment strategies to adapt.

The changes don’t stop there. From FNSKU-level low-inventory fees to doubled aged inventory charges and the new DD+7 payout delay starting March 12, 2026, sellers face a series of cumulative impacts. Industry experts emphasize that success in 2026 will demand efficient processes, better preparation, and leaner inventory management. This means auditing every SKU with tools like the Amazon Revenue Calculator, shifting prep work to a 3PL or in-house team as soon as possible, and maintaining inventory levels within the ideal 60–90 day range.

Action needs to be taken now. Reassess your margins, streamline packaging to meet SIPP certification, and build cash reserves to handle the extended payout delays. These steps align with earlier advice on recalculating margins and optimizing inventory. If the scale of these changes feels overwhelming, eStore Factory offers expert guidance to help sellers adjust to the new fee structures, refine pricing strategies, and maintain healthy inventory levels.

FAQs

How can sellers adapt to Amazon ending FBA prep and labeling services?

Amazon has announced that it will phase out its in-house FBA prep and labeling services starting January 1, 2026. This means all products must arrive at Amazon's fulfillment centers fully prepared according to their packaging, labeling, and safety standards. To adapt to this change while protecting your bottom line, here are a few practical steps sellers can take:

Streamline your prep process: Set up an organized workflow for tasks like labeling, poly-bagging, and bundling. Equip your team with tools such as label printers and ensure they’re familiar with Amazon’s latest packaging requirements.

Leverage third-party prep services: Collaborate with a reliable prep company or 3PL provider that specializes in Amazon compliance. These professionals can handle the heavy lifting and help you avoid shipment rejections.

Seek expert advice: Agencies like eStore Factory can provide guidance on refining your prep operations, integrating automation tools, and staying aligned with Amazon’s updated policies.

Starting preparations now can help sellers avoid disruptions, reduce costly mistakes, and ensure their FBA operations continue to run smoothly.

How can sellers manage cash flow effectively under Amazon's new DD+7 payout policy?

Amazon's new DD+7 payout policy means sellers now have to wait seven days after a customer's delivery to access their funds. This delay can make cash flow management trickier, especially during high-demand periods. To navigate this, sellers should focus on building a cash reserve that can cover at least one payout cycle. Keep in mind seasonal surges like Q4 or Prime Day when calculating how much to set aside.

Pair this with smart inventory planning. Pre-stock fast-selling items and stagger shipments to ensure you don’t run out of stock while waiting for funds to clear. This approach can keep operations running smoothly without tying up too much capital.

If cash flow becomes tight, external financing options like short-term business loans or lines of credit can bridge the gap during the delay. Another strategy is to negotiate supplier payment terms - such as net-30 or net-45 - that better align with the DD+7 schedule, reducing the mismatch between your outgoing payments and incoming funds.

Finally, be mindful of your spending on ads and promotions during these payout lag periods. Scaling back slightly or timing campaigns strategically can help maintain liquidity without overextending your budget. With thoughtful adjustments, sellers can manage these changes and keep their businesses on track.

How will the new inbound defect fees impact sellers' costs?

Amazon's new inbound defect fees introduce extra charges for shipments that don't align with their packaging, labeling, or shipping standards. For many sellers, this could mean higher expenses, potentially squeezing profit margins unless adjustments are made to shipping practices.

To avoid these added costs, sellers should prioritize precise labeling, sturdy packaging, and ensuring every shipment adheres to Amazon's requirements. By tackling these areas head-on, you can keep expenses in check and safeguard your profits.