Back to Page

Amazon Keyword Research

Crack the Code: Advanced Keyword Research Techniques for 2026 Amazon Success

Crack the Code: Advanced Keyword Research Techniques for 2026 Amazon Success

Back to Page

Amazon Keyword Research

Crack the Code: Advanced Keyword Research Techniques for 2026 Amazon Success

Dec 23, 2025

TL;DR

In 2026, Amazon keyword research is driven by buyer intent and conversion behavior, not search volume. High-intent keywords consistently outperform high-traffic terms that attract browsers.

Amazon now re-ranks keywords based on post-click performance, including conversion rate, engagement, and sales velocity, making relevance more important than visibility.

Mapping keywords to the buyer journey improves conversion, lowers wasted ad spend, and strengthens organic ranking.

Long-tail, intent-rich keywords often deliver higher sales and profit than generic terms, even with lower search volume.

Keyword data must guide PPC, SEO, listing content, and A+ Content together. Disconnected strategies increase CPC and weaken relevance signals.

Sellers who use AI-driven systems to prune weak keywords, fix listing gaps, and reinforce high-performing intent keywords gain more control, lower costs, and more predictable growth in 2026.

Why are your keywords getting clicks… but your sales graph keeps sliding down?

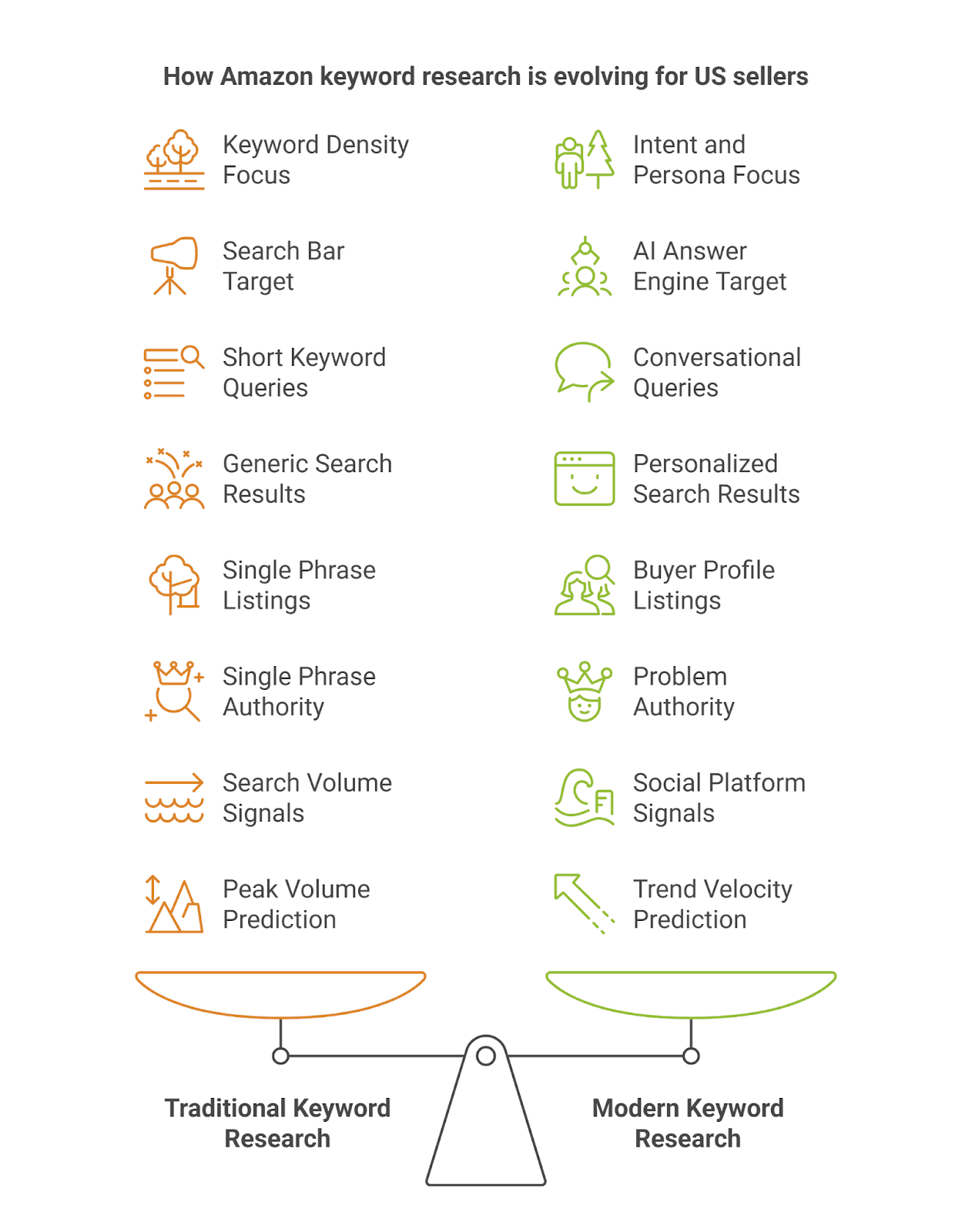

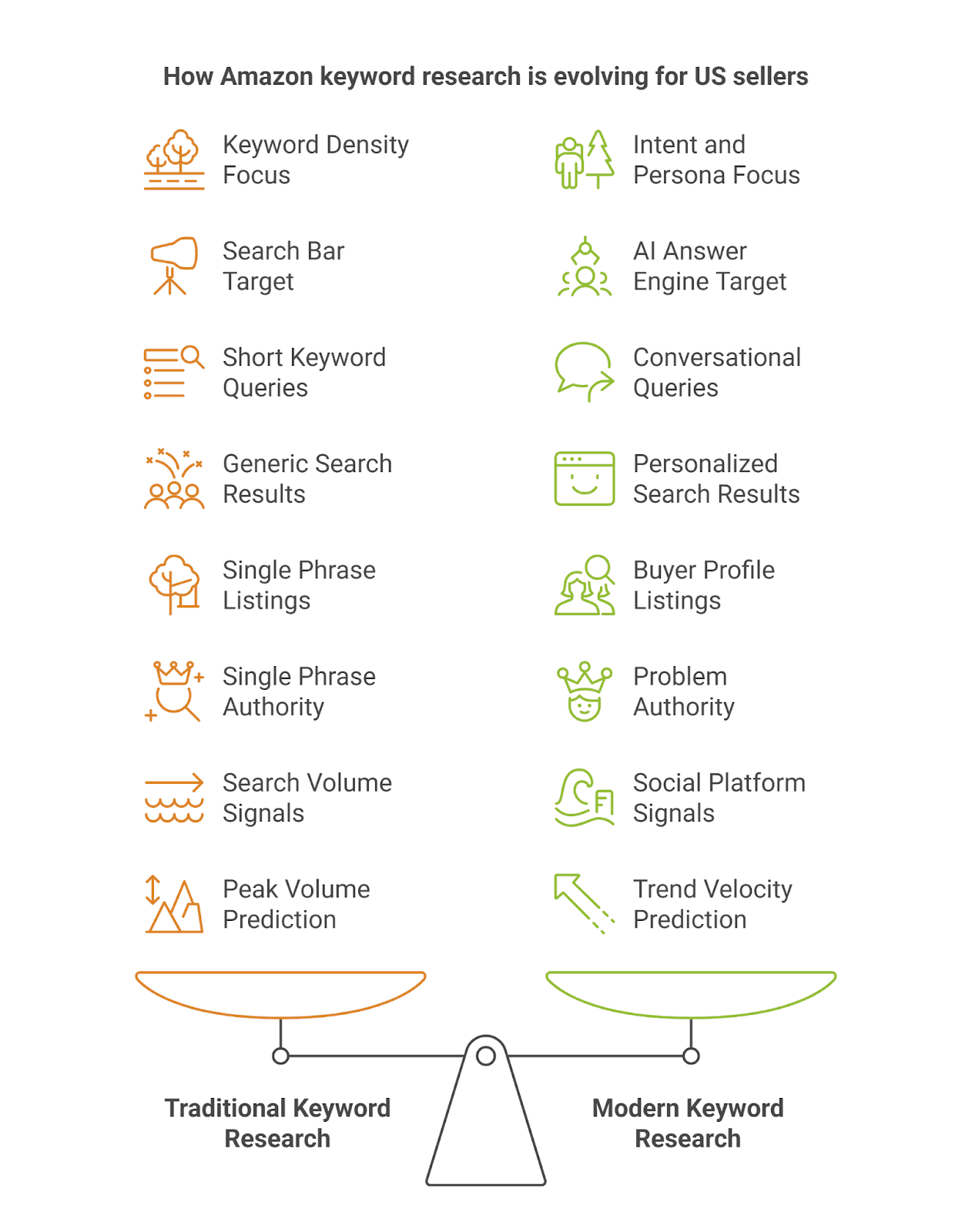

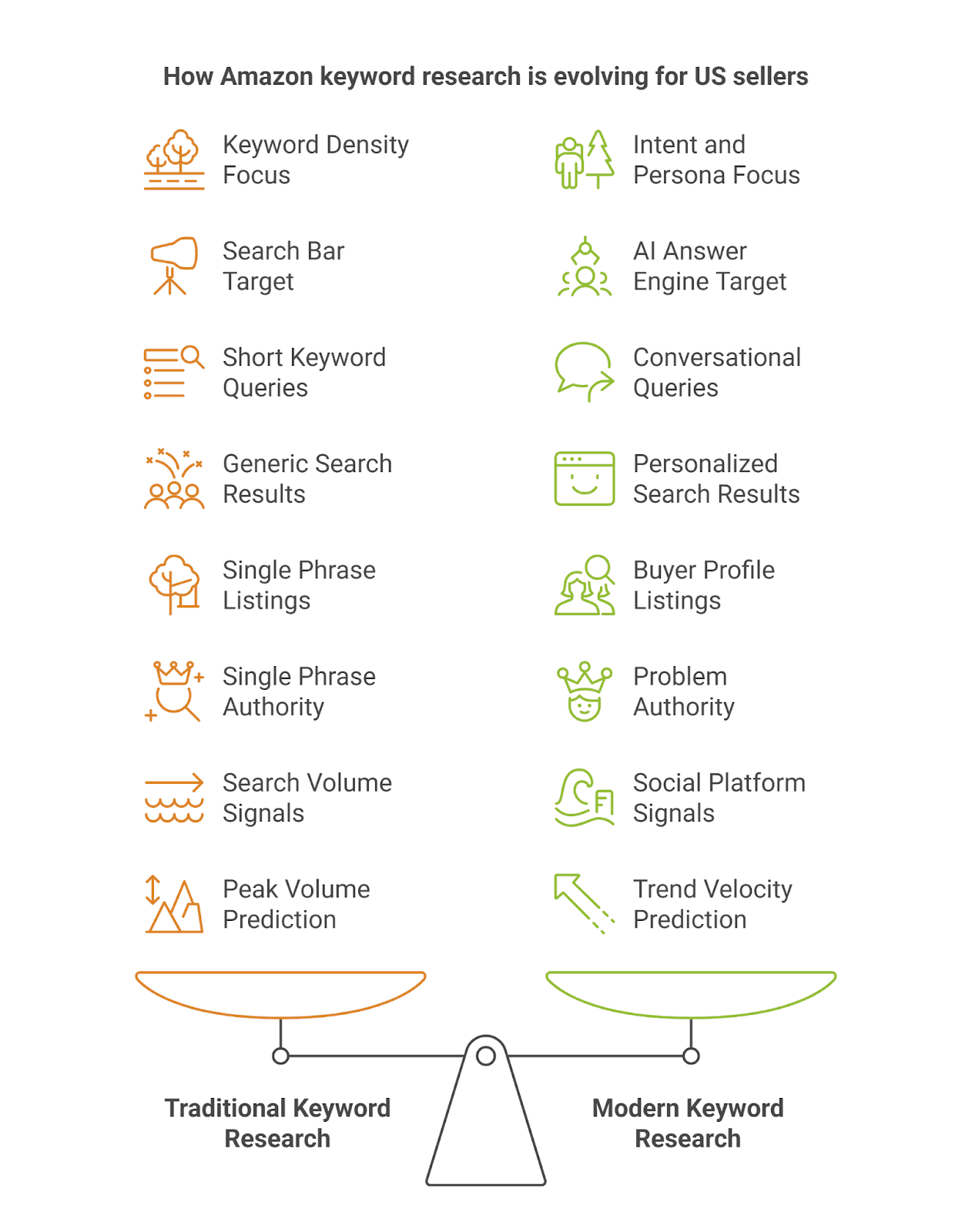

If your keyword strategy still revolves around search volume charts and long keyword lists, Amazon in 2026 can feel confusing and expensive. That is because keyword research is no longer about stuffing terms into listings and hoping traffic turns into sales.

Amazon keyword research has shifted to an outcome-driven system that prioritizes buyer intent and purchase likelihood over raw visibility. Many US sellers are losing relevance because they rely on old keyword tools that track popularity, not readiness to buy.

Amazon now weighs intent, conversion probability, and how your ASIN has historically performed for similar searches. Clicks without sales are no longer neutral. Search results are shaped by behavior, not assumptions. Listings that convert, engage, and satisfy shoppers earn visibility. Those that attract browsers quietly fade, even when impressions look fine.

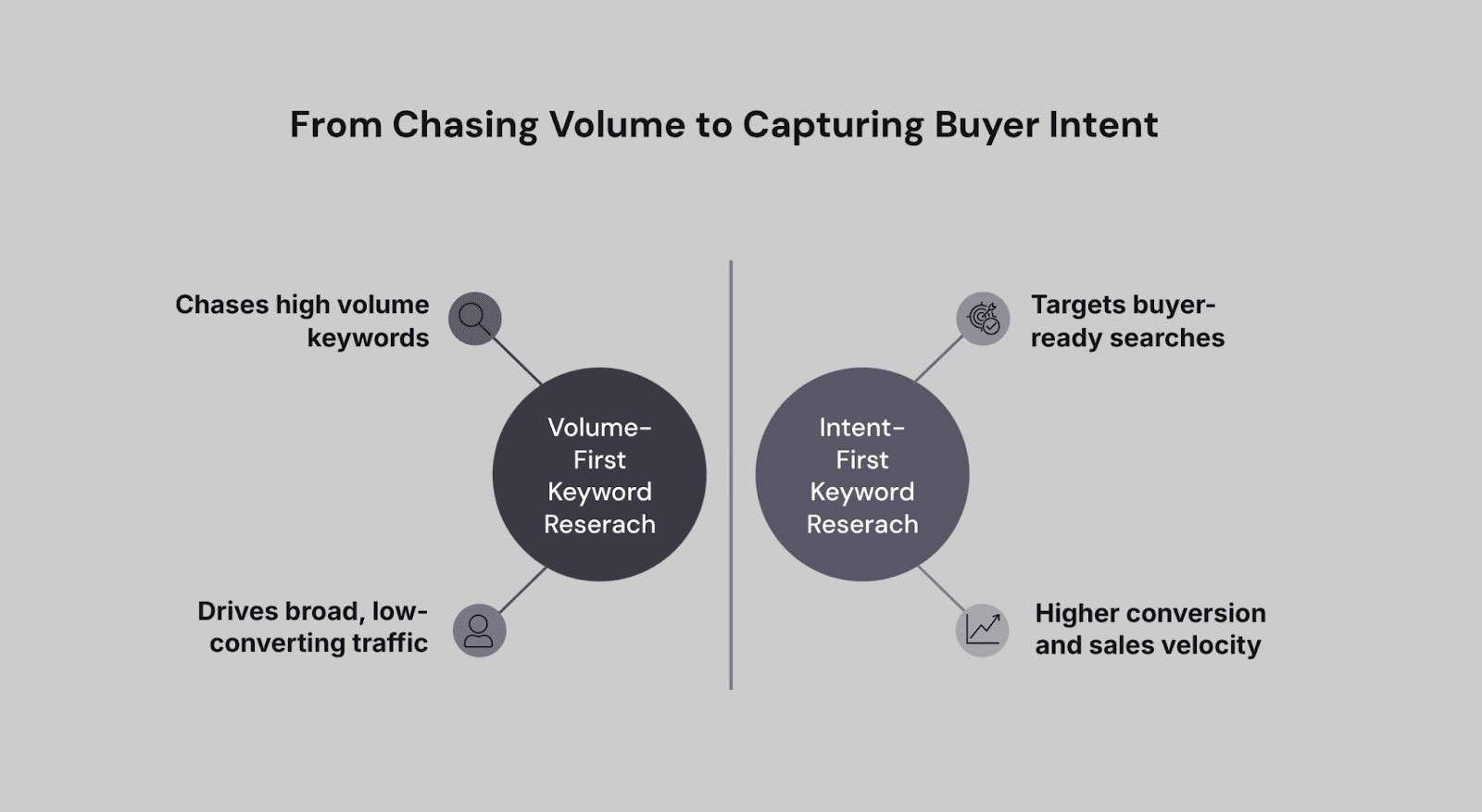

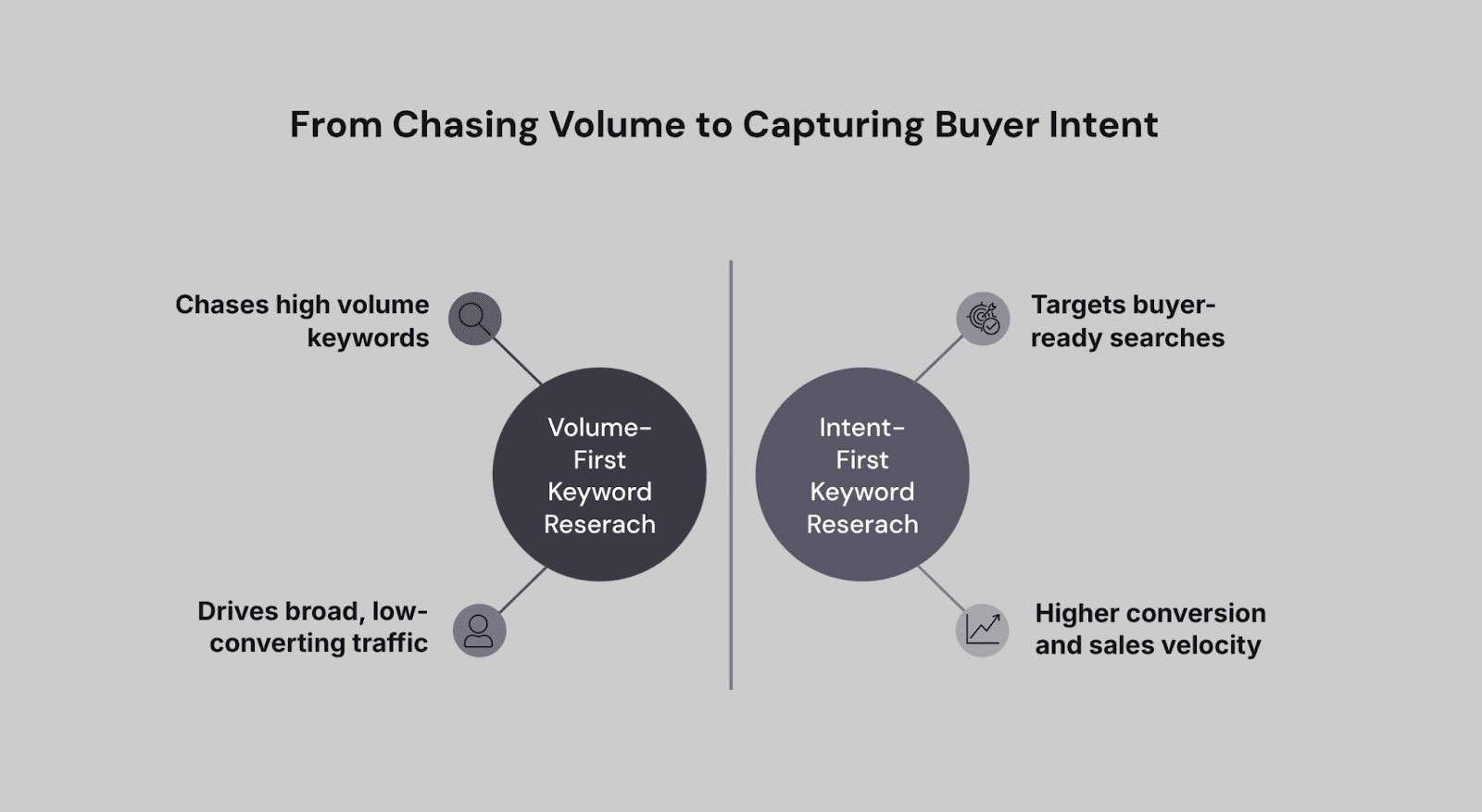

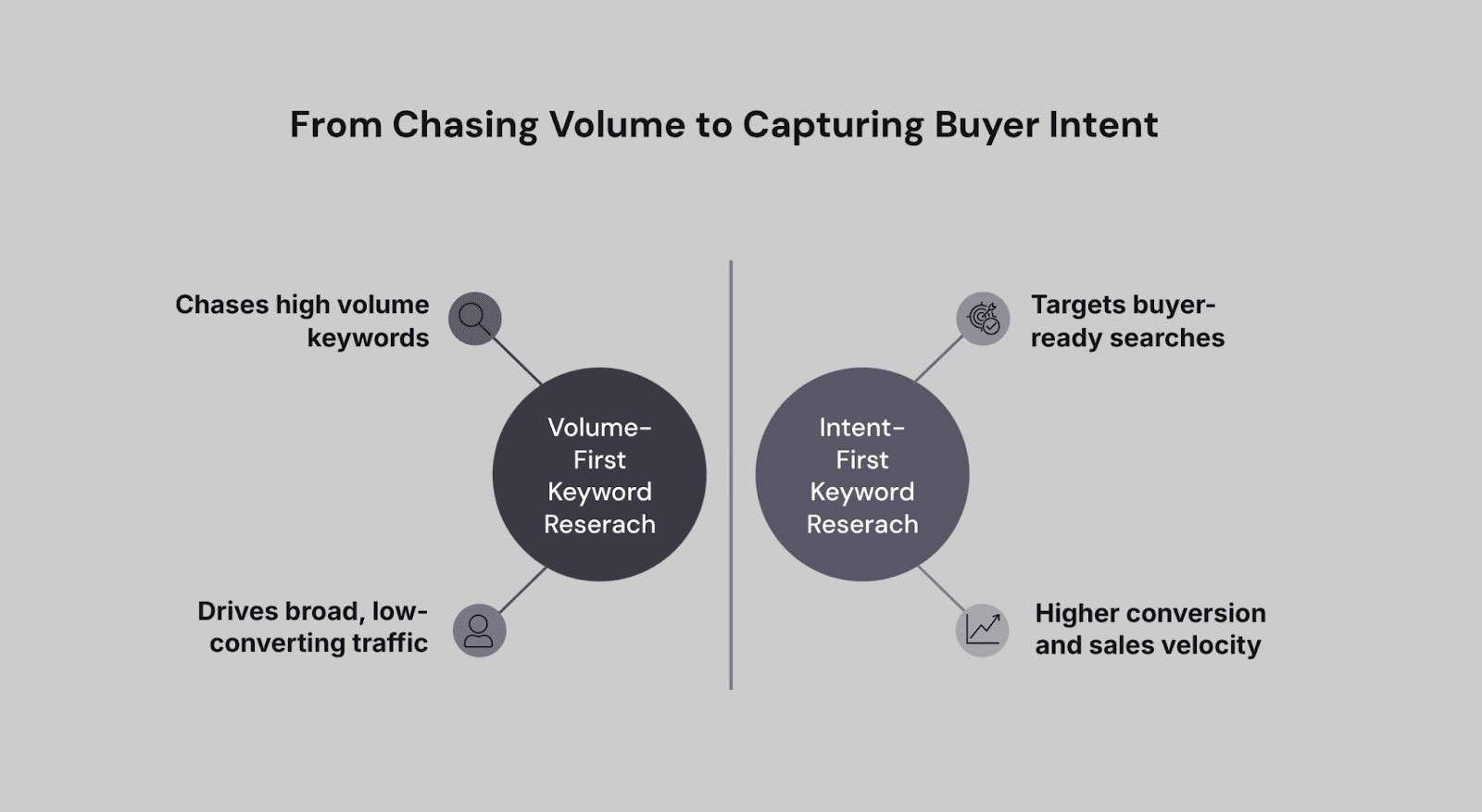

The shift from “high volume” to “high intent” keywords

In 2026, winning on Amazon is no longer about chasing the high volume, long keyword. It is about chasing the buyer who is ready to purchase. Amazon’s A9 algorithm now prioritizes high-intent keywords that lead to real conversions, not empty traffic.

US sellers who shift from volume-first thinking to intent-based keyword strategies are seeing 2 to 3 times higher sales velocity because Amazon reads buyer readiness, not just search counts.

High-volume terms like “wireless earbuds” attract browsers, not buyers. They convert at under 1 percent and get diluted by AI-curated results that serve very specific needs. In contrast, intent-rich searches like “wireless earbuds for running sweatproof under $50” drive higher click-through rates, lower bounce rates, and stronger post-click signals. That is exactly what Amazon rewards.

The algorithm actively tracks what happens after the click. Keywords converting above 5 percent get an intent boost, leading to faster indexation, better placements, and Sponsored Product priority, even with lower bids. Volume terms that do not convert quietly slide down rankings.

Real US brands are already proving this works. Low-volume intent keywords are outperforming massive generic terms by 4x sales, lifting profits and organic share by focusing on conversion clusters, not vanity metrics.

US brands using this approach are seeing the shift clearly. Low-volume intent keywords are driving 4x more sales than generic terms, lifting profits by over 30 percent. In 2026, the real growth lever is not more traffic. It is better intent-based keyword optimization.

Understand keyword intent across the US buyer journey

Most US sellers treat keywords like a flat list. Buyers do not shop that way. Every search sits somewhere on a journey, and in 2026, Amazon clearly understands that journey better than most sellers do.

Buyer stage | Intent type | Common US search examples | What the shopper is really doing |

Top funnel | Research and discovery | “best [category]”, “how to use a [product]”, “gifts for [persona]” | The shopper is learning and exploring options. They are not ready to buy yet. Traffic is high, but conversions are low. |

Mid funnel | Comparison and evaluation | “[Brand A] vs [Brand B]”, “[product] near me”, “[product] with [feature]” | The shopper knows what they want and is comparing choices. Conversions improve, but decisions are still being weighed. |

Bottom funnel | Purchase and transactional | “[Brand name] [product model]”, “buy [product] now”, “cheapest [product]” | The shopper is ready to purchase. Search volume is lower, but conversion rates are the highest. |

In 2026, profitability on Amazon is less about how much you spend and more about where you spend it. Keyword intent is what separates ads that quietly burn budget from ads that actually move revenue.

High-volume research keywords are the usual trap. They look attractive because everyone is searching for them, but those shoppers are mostly browsing.

Competition pushes CPCs up, clicks pile in, and conversions stay low. The result is familiar to most US sellers. A fast budget drain and an ACoS that never seems to come down.

High-intent purchase keywords behave very differently. These shoppers already know what they want and are close to buying.

Conversion rates often land in the 15 to 25 percent range, sometimes higher. Even if the CPC looks expensive on paper, the click is worth it because it turns into a sale.

This is also where Amazon’s algorithm starts working in your favor. When a keyword consistently converts, Amazon treats it as valuable traffic. Over time, those ads get better placement, more stable delivery, and lower effective CPC. You are not just buying clicks; you are training the system to prioritize your listing.

The real win in 2026 is not just finding better keywords. It is knowing how to use them across your entire Amazon setup. When your keyword research is done right, it does more than feed your ads or tweak your title. It shapes how shoppers experience your brand at every step.

Keyword intent | Where to use it on your listing | Best ad types to support it |

Research and discovery | A+ Content that explains benefits, lifestyle images that show use cases, Q&A that removes early doubts, and your Brand Store for storytelling | Sponsored Display for awareness, video ads to educate and warm up the shopper |

Comparison and evaluation | Bullet points that clearly answer “why this one,” product descriptions with specs and details, and comparison charts that make decisions easier | Sponsored Products using auto and broad match to capture shoppers comparing options |

Purchase and transactional | Title for relevance, backend search terms for indexing, competitive pricing, strong star rating, and a clean main image that builds trust instantly | Sponsored Products with exact match and higher bids, Sponsored Brands using branded and high-intent terms |

When keywords are placed where shoppers expect them through advanced keyword research for Amazon PPC, everything starts working together. Listings feel clearer, ads waste less spend, and Amazon sees stronger post-click behavior. Instead of forcing one keyword to do everything, you let each intent stage do its job, and that is how performance scales in 2026.

How Amazon uses performance data to re-rank keywords in 2026

Amazon does not lock keyword rankings in place anymore. They move constantly, based on how real shoppers behave, often hour by hour. While full updates can take a day or two to settle, the system is always watching performance signals in the background.

Sales velocity still leads the pack. Keywords that move shoppers from search to purchase quickly gain trust fast. Conversion rate adds another layer. If one keyword converts at 15 percent and another struggles at 2 percent, Amazon clearly knows which one deserves visibility.

Engagement now matters more than ever. Time spent on your listing, scrolling, and interaction with A+ content all signal relevance, sometimes even before a sale happens.

Paid advertising helps open the door, but organic performance keeps it open. PPC can teach Amazon relevance early, but long-term ranking is driven by organic sales.

External traffic also plays a bigger role. Brands that bring shoppers from platforms like social media are rewarded for adding value to Amazon’s ecosystem.

On top of this, search results are increasingly personalized. Rankings change based on shopper behavior, meaning there is no single fixed position anymore. Performance, not promises, decides visibility.

Keyword mistakes US sellers still make in 2025

#1 Chasing competitor keywords

Sellers bid aggressively on competitor brand terms, assuming shoppers will switch. In reality, most buyers are already committed, leading to high CPCs, low CVR, and wasted spend.

#2 Treat awareness keywords like revenue drivers

Broad, high-volume keywords are often funded like performance terms. This inflates CPC, drains the budget early, and pushes ACoS up without contributing meaningful sales.

#3 Ignore long-tail keywords

Many sellers skip long-tail terms under a few thousand searches, missing keywords that quietly deliver consistent conversions and compound organic ranking over time.

#4 Use the same keywords everywhere without intent mapping

Placing research, comparison, and purchase keywords in the same campaigns and listing sections weakens relevance and confuses Amazon’s algorithm.

#5 Over-optimizing backend search terms

Stuffing backend fields with high-volume keywords that do not convert reduces indexing efficiency and can dilute performance signals.

#6 Not pruning keywords that have stopped performing

Keywords that once worked often linger in campaigns long after conversion drops. Amazon reads this as poor relevance, slowly dragging overall account performance down.

#7 Measure success by impressions instead of sales impact

High visibility feels good, but impressions without engagement train the algorithm to deprioritize your listing over time.

Turn keyword data into real actions with automation

Most US sellers are not struggling because they lack keyword data. Spreadsheets keep getting bigger, tools keep exporting more terms, and performance still feels stuck. That is because adding more keywords rarely improves targeting. It usually does the opposite. It spreads thinner, pulls in the wrong traffic, and sends mixed signals to Amazon’s algorithm.

The shift in 2026 is about control, not coverage. Profitable keywords need to be treated like assets, not experiments. That means tighter match types, cleaner bids, and intentional placement inside your listing where buyers expect to see them.

At the same time, weak keywords that generate clicks without sales need to be pruned quickly. Leaving them active slowly trains Amazon to associate your ASIN with low-intent traffic. Keyword data should also do more than optimize ads.

Conversion drops often highlight listing issues, unclear images, missing context in bullets, or A+ content that does not answer buyer questions. Fixing the listing often restores keyword performance faster than any bid change.

This is where SellerQI, an AI-driven analytics and operational monitoring tool for sellers, adds real value. Instead of dumping generic keyword lists, it surfaces ASIN-level gaps tied to actual conversion behavior. You can see which keywords attract interest but lose buyers, where intent is mismatched, and exactly what needs fixing. That is how keyword data becomes action, not noise.

How advanced sellers align keyword research with PPC, SEO, and content

Advanced sellers do not treat keyword research as a one-time task or a PPC-only job. They use it as the backbone of everything they do on Amazon. Here is how that alignment actually works in practice:

One keyword plan, not three different ones: Keywords that drive ads should also shape your listing and A+ content. When ads promise one thing and listings show another, conversion drops and CPC climbs fast.

Ads create signals; listings turn them into sales: PPC brings the traffic, but your title, bullets, images, and A+ decide whether that click is worth anything. Weak listings force you to overbid just to stay visible.

Misalignment quietly kills organic growth: When keywords in ads do not appear naturally in your content, Amazon sees poor relevance. That leads to higher CPCs, slower indexing, and weaker organic ranking over time.

Amazon A+ Content supports keyword intent: High-intent keywords should be reinforced visually and contextually in A+ Content. This improves dwell time and strengthens relevance signals.

One system beats disconnected efforts: Advanced sellers build a single keyword system that feeds PPC, SEO, and content together. Every update strengthens the whole structure, not just one channel.

The future of keyword research for Amazon US sellers

Final insights

Amazon keyword research in 2026 is no longer a guessing game. It is a feedback loop. Every click, scroll, and purchase teaches Amazon who your product is really for. Sellers who keep chasing volume will keep paying more for less. Sellers who align keywords with intent, content, and performance will compound results over time.

The advantage now comes from clarity. Clear intent. Clear listings. Clear signals were sent back to the algorithm. When keywords are mapped to the buyer journey, supported by strong content, and reinforced by conversion data, growth stops feeling random.

If you want keyword ranking that feels controlled, not chaotic, explore eStore Factory’s AI-driven Amazon keyword ranking strategy and turn raw data into steady, scalable growth.

TL;DR

In 2026, Amazon keyword research is driven by buyer intent and conversion behavior, not search volume. High-intent keywords consistently outperform high-traffic terms that attract browsers.

Amazon now re-ranks keywords based on post-click performance, including conversion rate, engagement, and sales velocity, making relevance more important than visibility.

Mapping keywords to the buyer journey improves conversion, lowers wasted ad spend, and strengthens organic ranking.

Long-tail, intent-rich keywords often deliver higher sales and profit than generic terms, even with lower search volume.

Keyword data must guide PPC, SEO, listing content, and A+ Content together. Disconnected strategies increase CPC and weaken relevance signals.

Sellers who use AI-driven systems to prune weak keywords, fix listing gaps, and reinforce high-performing intent keywords gain more control, lower costs, and more predictable growth in 2026.

Why are your keywords getting clicks… but your sales graph keeps sliding down?

If your keyword strategy still revolves around search volume charts and long keyword lists, Amazon in 2026 can feel confusing and expensive. That is because keyword research is no longer about stuffing terms into listings and hoping traffic turns into sales.

Amazon keyword research has shifted to an outcome-driven system that prioritizes buyer intent and purchase likelihood over raw visibility. Many US sellers are losing relevance because they rely on old keyword tools that track popularity, not readiness to buy.

Amazon now weighs intent, conversion probability, and how your ASIN has historically performed for similar searches. Clicks without sales are no longer neutral. Search results are shaped by behavior, not assumptions. Listings that convert, engage, and satisfy shoppers earn visibility. Those that attract browsers quietly fade, even when impressions look fine.

The shift from “high volume” to “high intent” keywords

In 2026, winning on Amazon is no longer about chasing the high volume, long keyword. It is about chasing the buyer who is ready to purchase. Amazon’s A9 algorithm now prioritizes high-intent keywords that lead to real conversions, not empty traffic.

US sellers who shift from volume-first thinking to intent-based keyword strategies are seeing 2 to 3 times higher sales velocity because Amazon reads buyer readiness, not just search counts.

High-volume terms like “wireless earbuds” attract browsers, not buyers. They convert at under 1 percent and get diluted by AI-curated results that serve very specific needs. In contrast, intent-rich searches like “wireless earbuds for running sweatproof under $50” drive higher click-through rates, lower bounce rates, and stronger post-click signals. That is exactly what Amazon rewards.

The algorithm actively tracks what happens after the click. Keywords converting above 5 percent get an intent boost, leading to faster indexation, better placements, and Sponsored Product priority, even with lower bids. Volume terms that do not convert quietly slide down rankings.

Real US brands are already proving this works. Low-volume intent keywords are outperforming massive generic terms by 4x sales, lifting profits and organic share by focusing on conversion clusters, not vanity metrics.

US brands using this approach are seeing the shift clearly. Low-volume intent keywords are driving 4x more sales than generic terms, lifting profits by over 30 percent. In 2026, the real growth lever is not more traffic. It is better intent-based keyword optimization.

Understand keyword intent across the US buyer journey

Most US sellers treat keywords like a flat list. Buyers do not shop that way. Every search sits somewhere on a journey, and in 2026, Amazon clearly understands that journey better than most sellers do.

Buyer stage | Intent type | Common US search examples | What the shopper is really doing |

Top funnel | Research and discovery | “best [category]”, “how to use a [product]”, “gifts for [persona]” | The shopper is learning and exploring options. They are not ready to buy yet. Traffic is high, but conversions are low. |

Mid funnel | Comparison and evaluation | “[Brand A] vs [Brand B]”, “[product] near me”, “[product] with [feature]” | The shopper knows what they want and is comparing choices. Conversions improve, but decisions are still being weighed. |

Bottom funnel | Purchase and transactional | “[Brand name] [product model]”, “buy [product] now”, “cheapest [product]” | The shopper is ready to purchase. Search volume is lower, but conversion rates are the highest. |

In 2026, profitability on Amazon is less about how much you spend and more about where you spend it. Keyword intent is what separates ads that quietly burn budget from ads that actually move revenue.

High-volume research keywords are the usual trap. They look attractive because everyone is searching for them, but those shoppers are mostly browsing.

Competition pushes CPCs up, clicks pile in, and conversions stay low. The result is familiar to most US sellers. A fast budget drain and an ACoS that never seems to come down.

High-intent purchase keywords behave very differently. These shoppers already know what they want and are close to buying.

Conversion rates often land in the 15 to 25 percent range, sometimes higher. Even if the CPC looks expensive on paper, the click is worth it because it turns into a sale.

This is also where Amazon’s algorithm starts working in your favor. When a keyword consistently converts, Amazon treats it as valuable traffic. Over time, those ads get better placement, more stable delivery, and lower effective CPC. You are not just buying clicks; you are training the system to prioritize your listing.

The real win in 2026 is not just finding better keywords. It is knowing how to use them across your entire Amazon setup. When your keyword research is done right, it does more than feed your ads or tweak your title. It shapes how shoppers experience your brand at every step.

Keyword intent | Where to use it on your listing | Best ad types to support it |

Research and discovery | A+ Content that explains benefits, lifestyle images that show use cases, Q&A that removes early doubts, and your Brand Store for storytelling | Sponsored Display for awareness, video ads to educate and warm up the shopper |

Comparison and evaluation | Bullet points that clearly answer “why this one,” product descriptions with specs and details, and comparison charts that make decisions easier | Sponsored Products using auto and broad match to capture shoppers comparing options |

Purchase and transactional | Title for relevance, backend search terms for indexing, competitive pricing, strong star rating, and a clean main image that builds trust instantly | Sponsored Products with exact match and higher bids, Sponsored Brands using branded and high-intent terms |

When keywords are placed where shoppers expect them through advanced keyword research for Amazon PPC, everything starts working together. Listings feel clearer, ads waste less spend, and Amazon sees stronger post-click behavior. Instead of forcing one keyword to do everything, you let each intent stage do its job, and that is how performance scales in 2026.

How Amazon uses performance data to re-rank keywords in 2026

Amazon does not lock keyword rankings in place anymore. They move constantly, based on how real shoppers behave, often hour by hour. While full updates can take a day or two to settle, the system is always watching performance signals in the background.

Sales velocity still leads the pack. Keywords that move shoppers from search to purchase quickly gain trust fast. Conversion rate adds another layer. If one keyword converts at 15 percent and another struggles at 2 percent, Amazon clearly knows which one deserves visibility.

Engagement now matters more than ever. Time spent on your listing, scrolling, and interaction with A+ content all signal relevance, sometimes even before a sale happens.

Paid advertising helps open the door, but organic performance keeps it open. PPC can teach Amazon relevance early, but long-term ranking is driven by organic sales.

External traffic also plays a bigger role. Brands that bring shoppers from platforms like social media are rewarded for adding value to Amazon’s ecosystem.

On top of this, search results are increasingly personalized. Rankings change based on shopper behavior, meaning there is no single fixed position anymore. Performance, not promises, decides visibility.

Keyword mistakes US sellers still make in 2025

#1 Chasing competitor keywords

Sellers bid aggressively on competitor brand terms, assuming shoppers will switch. In reality, most buyers are already committed, leading to high CPCs, low CVR, and wasted spend.

#2 Treat awareness keywords like revenue drivers

Broad, high-volume keywords are often funded like performance terms. This inflates CPC, drains the budget early, and pushes ACoS up without contributing meaningful sales.

#3 Ignore long-tail keywords

Many sellers skip long-tail terms under a few thousand searches, missing keywords that quietly deliver consistent conversions and compound organic ranking over time.

#4 Use the same keywords everywhere without intent mapping

Placing research, comparison, and purchase keywords in the same campaigns and listing sections weakens relevance and confuses Amazon’s algorithm.

#5 Over-optimizing backend search terms

Stuffing backend fields with high-volume keywords that do not convert reduces indexing efficiency and can dilute performance signals.

#6 Not pruning keywords that have stopped performing

Keywords that once worked often linger in campaigns long after conversion drops. Amazon reads this as poor relevance, slowly dragging overall account performance down.

#7 Measure success by impressions instead of sales impact

High visibility feels good, but impressions without engagement train the algorithm to deprioritize your listing over time.

Turn keyword data into real actions with automation

Most US sellers are not struggling because they lack keyword data. Spreadsheets keep getting bigger, tools keep exporting more terms, and performance still feels stuck. That is because adding more keywords rarely improves targeting. It usually does the opposite. It spreads thinner, pulls in the wrong traffic, and sends mixed signals to Amazon’s algorithm.

The shift in 2026 is about control, not coverage. Profitable keywords need to be treated like assets, not experiments. That means tighter match types, cleaner bids, and intentional placement inside your listing where buyers expect to see them.

At the same time, weak keywords that generate clicks without sales need to be pruned quickly. Leaving them active slowly trains Amazon to associate your ASIN with low-intent traffic. Keyword data should also do more than optimize ads.

Conversion drops often highlight listing issues, unclear images, missing context in bullets, or A+ content that does not answer buyer questions. Fixing the listing often restores keyword performance faster than any bid change.

This is where SellerQI, an AI-driven analytics and operational monitoring tool for sellers, adds real value. Instead of dumping generic keyword lists, it surfaces ASIN-level gaps tied to actual conversion behavior. You can see which keywords attract interest but lose buyers, where intent is mismatched, and exactly what needs fixing. That is how keyword data becomes action, not noise.

How advanced sellers align keyword research with PPC, SEO, and content

Advanced sellers do not treat keyword research as a one-time task or a PPC-only job. They use it as the backbone of everything they do on Amazon. Here is how that alignment actually works in practice:

One keyword plan, not three different ones: Keywords that drive ads should also shape your listing and A+ content. When ads promise one thing and listings show another, conversion drops and CPC climbs fast.

Ads create signals; listings turn them into sales: PPC brings the traffic, but your title, bullets, images, and A+ decide whether that click is worth anything. Weak listings force you to overbid just to stay visible.

Misalignment quietly kills organic growth: When keywords in ads do not appear naturally in your content, Amazon sees poor relevance. That leads to higher CPCs, slower indexing, and weaker organic ranking over time.

Amazon A+ Content supports keyword intent: High-intent keywords should be reinforced visually and contextually in A+ Content. This improves dwell time and strengthens relevance signals.

One system beats disconnected efforts: Advanced sellers build a single keyword system that feeds PPC, SEO, and content together. Every update strengthens the whole structure, not just one channel.

The future of keyword research for Amazon US sellers

Final insights

Amazon keyword research in 2026 is no longer a guessing game. It is a feedback loop. Every click, scroll, and purchase teaches Amazon who your product is really for. Sellers who keep chasing volume will keep paying more for less. Sellers who align keywords with intent, content, and performance will compound results over time.

The advantage now comes from clarity. Clear intent. Clear listings. Clear signals were sent back to the algorithm. When keywords are mapped to the buyer journey, supported by strong content, and reinforced by conversion data, growth stops feeling random.

If you want keyword ranking that feels controlled, not chaotic, explore eStore Factory’s AI-driven Amazon keyword ranking strategy and turn raw data into steady, scalable growth.

TL;DR

In 2026, Amazon keyword research is driven by buyer intent and conversion behavior, not search volume. High-intent keywords consistently outperform high-traffic terms that attract browsers.

Amazon now re-ranks keywords based on post-click performance, including conversion rate, engagement, and sales velocity, making relevance more important than visibility.

Mapping keywords to the buyer journey improves conversion, lowers wasted ad spend, and strengthens organic ranking.

Long-tail, intent-rich keywords often deliver higher sales and profit than generic terms, even with lower search volume.

Keyword data must guide PPC, SEO, listing content, and A+ Content together. Disconnected strategies increase CPC and weaken relevance signals.

Sellers who use AI-driven systems to prune weak keywords, fix listing gaps, and reinforce high-performing intent keywords gain more control, lower costs, and more predictable growth in 2026.

Why are your keywords getting clicks… but your sales graph keeps sliding down?

If your keyword strategy still revolves around search volume charts and long keyword lists, Amazon in 2026 can feel confusing and expensive. That is because keyword research is no longer about stuffing terms into listings and hoping traffic turns into sales.

Amazon keyword research has shifted to an outcome-driven system that prioritizes buyer intent and purchase likelihood over raw visibility. Many US sellers are losing relevance because they rely on old keyword tools that track popularity, not readiness to buy.

Amazon now weighs intent, conversion probability, and how your ASIN has historically performed for similar searches. Clicks without sales are no longer neutral. Search results are shaped by behavior, not assumptions. Listings that convert, engage, and satisfy shoppers earn visibility. Those that attract browsers quietly fade, even when impressions look fine.

The shift from “high volume” to “high intent” keywords

In 2026, winning on Amazon is no longer about chasing the high volume, long keyword. It is about chasing the buyer who is ready to purchase. Amazon’s A9 algorithm now prioritizes high-intent keywords that lead to real conversions, not empty traffic.

US sellers who shift from volume-first thinking to intent-based keyword strategies are seeing 2 to 3 times higher sales velocity because Amazon reads buyer readiness, not just search counts.

High-volume terms like “wireless earbuds” attract browsers, not buyers. They convert at under 1 percent and get diluted by AI-curated results that serve very specific needs. In contrast, intent-rich searches like “wireless earbuds for running sweatproof under $50” drive higher click-through rates, lower bounce rates, and stronger post-click signals. That is exactly what Amazon rewards.

The algorithm actively tracks what happens after the click. Keywords converting above 5 percent get an intent boost, leading to faster indexation, better placements, and Sponsored Product priority, even with lower bids. Volume terms that do not convert quietly slide down rankings.

Real US brands are already proving this works. Low-volume intent keywords are outperforming massive generic terms by 4x sales, lifting profits and organic share by focusing on conversion clusters, not vanity metrics.

US brands using this approach are seeing the shift clearly. Low-volume intent keywords are driving 4x more sales than generic terms, lifting profits by over 30 percent. In 2026, the real growth lever is not more traffic. It is better intent-based keyword optimization.

Understand keyword intent across the US buyer journey

Most US sellers treat keywords like a flat list. Buyers do not shop that way. Every search sits somewhere on a journey, and in 2026, Amazon clearly understands that journey better than most sellers do.

Buyer stage | Intent type | Common US search examples | What the shopper is really doing |

Top funnel | Research and discovery | “best [category]”, “how to use a [product]”, “gifts for [persona]” | The shopper is learning and exploring options. They are not ready to buy yet. Traffic is high, but conversions are low. |

Mid funnel | Comparison and evaluation | “[Brand A] vs [Brand B]”, “[product] near me”, “[product] with [feature]” | The shopper knows what they want and is comparing choices. Conversions improve, but decisions are still being weighed. |

Bottom funnel | Purchase and transactional | “[Brand name] [product model]”, “buy [product] now”, “cheapest [product]” | The shopper is ready to purchase. Search volume is lower, but conversion rates are the highest. |

In 2026, profitability on Amazon is less about how much you spend and more about where you spend it. Keyword intent is what separates ads that quietly burn budget from ads that actually move revenue.

High-volume research keywords are the usual trap. They look attractive because everyone is searching for them, but those shoppers are mostly browsing.

Competition pushes CPCs up, clicks pile in, and conversions stay low. The result is familiar to most US sellers. A fast budget drain and an ACoS that never seems to come down.

High-intent purchase keywords behave very differently. These shoppers already know what they want and are close to buying.

Conversion rates often land in the 15 to 25 percent range, sometimes higher. Even if the CPC looks expensive on paper, the click is worth it because it turns into a sale.

This is also where Amazon’s algorithm starts working in your favor. When a keyword consistently converts, Amazon treats it as valuable traffic. Over time, those ads get better placement, more stable delivery, and lower effective CPC. You are not just buying clicks; you are training the system to prioritize your listing.

The real win in 2026 is not just finding better keywords. It is knowing how to use them across your entire Amazon setup. When your keyword research is done right, it does more than feed your ads or tweak your title. It shapes how shoppers experience your brand at every step.

Keyword intent | Where to use it on your listing | Best ad types to support it |

Research and discovery | A+ Content that explains benefits, lifestyle images that show use cases, Q&A that removes early doubts, and your Brand Store for storytelling | Sponsored Display for awareness, video ads to educate and warm up the shopper |

Comparison and evaluation | Bullet points that clearly answer “why this one,” product descriptions with specs and details, and comparison charts that make decisions easier | Sponsored Products using auto and broad match to capture shoppers comparing options |

Purchase and transactional | Title for relevance, backend search terms for indexing, competitive pricing, strong star rating, and a clean main image that builds trust instantly | Sponsored Products with exact match and higher bids, Sponsored Brands using branded and high-intent terms |

When keywords are placed where shoppers expect them through advanced keyword research for Amazon PPC, everything starts working together. Listings feel clearer, ads waste less spend, and Amazon sees stronger post-click behavior. Instead of forcing one keyword to do everything, you let each intent stage do its job, and that is how performance scales in 2026.

How Amazon uses performance data to re-rank keywords in 2026

Amazon does not lock keyword rankings in place anymore. They move constantly, based on how real shoppers behave, often hour by hour. While full updates can take a day or two to settle, the system is always watching performance signals in the background.

Sales velocity still leads the pack. Keywords that move shoppers from search to purchase quickly gain trust fast. Conversion rate adds another layer. If one keyword converts at 15 percent and another struggles at 2 percent, Amazon clearly knows which one deserves visibility.

Engagement now matters more than ever. Time spent on your listing, scrolling, and interaction with A+ content all signal relevance, sometimes even before a sale happens.

Paid advertising helps open the door, but organic performance keeps it open. PPC can teach Amazon relevance early, but long-term ranking is driven by organic sales.

External traffic also plays a bigger role. Brands that bring shoppers from platforms like social media are rewarded for adding value to Amazon’s ecosystem.

On top of this, search results are increasingly personalized. Rankings change based on shopper behavior, meaning there is no single fixed position anymore. Performance, not promises, decides visibility.

Keyword mistakes US sellers still make in 2025

#1 Chasing competitor keywords

Sellers bid aggressively on competitor brand terms, assuming shoppers will switch. In reality, most buyers are already committed, leading to high CPCs, low CVR, and wasted spend.

#2 Treat awareness keywords like revenue drivers

Broad, high-volume keywords are often funded like performance terms. This inflates CPC, drains the budget early, and pushes ACoS up without contributing meaningful sales.

#3 Ignore long-tail keywords

Many sellers skip long-tail terms under a few thousand searches, missing keywords that quietly deliver consistent conversions and compound organic ranking over time.

#4 Use the same keywords everywhere without intent mapping

Placing research, comparison, and purchase keywords in the same campaigns and listing sections weakens relevance and confuses Amazon’s algorithm.

#5 Over-optimizing backend search terms

Stuffing backend fields with high-volume keywords that do not convert reduces indexing efficiency and can dilute performance signals.

#6 Not pruning keywords that have stopped performing

Keywords that once worked often linger in campaigns long after conversion drops. Amazon reads this as poor relevance, slowly dragging overall account performance down.

#7 Measure success by impressions instead of sales impact

High visibility feels good, but impressions without engagement train the algorithm to deprioritize your listing over time.

Turn keyword data into real actions with automation

Most US sellers are not struggling because they lack keyword data. Spreadsheets keep getting bigger, tools keep exporting more terms, and performance still feels stuck. That is because adding more keywords rarely improves targeting. It usually does the opposite. It spreads thinner, pulls in the wrong traffic, and sends mixed signals to Amazon’s algorithm.

The shift in 2026 is about control, not coverage. Profitable keywords need to be treated like assets, not experiments. That means tighter match types, cleaner bids, and intentional placement inside your listing where buyers expect to see them.

At the same time, weak keywords that generate clicks without sales need to be pruned quickly. Leaving them active slowly trains Amazon to associate your ASIN with low-intent traffic. Keyword data should also do more than optimize ads.

Conversion drops often highlight listing issues, unclear images, missing context in bullets, or A+ content that does not answer buyer questions. Fixing the listing often restores keyword performance faster than any bid change.

This is where SellerQI, an AI-driven analytics and operational monitoring tool for sellers, adds real value. Instead of dumping generic keyword lists, it surfaces ASIN-level gaps tied to actual conversion behavior. You can see which keywords attract interest but lose buyers, where intent is mismatched, and exactly what needs fixing. That is how keyword data becomes action, not noise.

How advanced sellers align keyword research with PPC, SEO, and content

Advanced sellers do not treat keyword research as a one-time task or a PPC-only job. They use it as the backbone of everything they do on Amazon. Here is how that alignment actually works in practice:

One keyword plan, not three different ones: Keywords that drive ads should also shape your listing and A+ content. When ads promise one thing and listings show another, conversion drops and CPC climbs fast.

Ads create signals; listings turn them into sales: PPC brings the traffic, but your title, bullets, images, and A+ decide whether that click is worth anything. Weak listings force you to overbid just to stay visible.

Misalignment quietly kills organic growth: When keywords in ads do not appear naturally in your content, Amazon sees poor relevance. That leads to higher CPCs, slower indexing, and weaker organic ranking over time.

Amazon A+ Content supports keyword intent: High-intent keywords should be reinforced visually and contextually in A+ Content. This improves dwell time and strengthens relevance signals.

One system beats disconnected efforts: Advanced sellers build a single keyword system that feeds PPC, SEO, and content together. Every update strengthens the whole structure, not just one channel.

The future of keyword research for Amazon US sellers

Final insights

Amazon keyword research in 2026 is no longer a guessing game. It is a feedback loop. Every click, scroll, and purchase teaches Amazon who your product is really for. Sellers who keep chasing volume will keep paying more for less. Sellers who align keywords with intent, content, and performance will compound results over time.

The advantage now comes from clarity. Clear intent. Clear listings. Clear signals were sent back to the algorithm. When keywords are mapped to the buyer journey, supported by strong content, and reinforced by conversion data, growth stops feeling random.

If you want keyword ranking that feels controlled, not chaotic, explore eStore Factory’s AI-driven Amazon keyword ranking strategy and turn raw data into steady, scalable growth.