Back to Page

Amazon Brand Store

The 97% lift: Proven tactics to transform your Amazon Brand Store from medium to high quality rating

The 97% lift: Proven tactics to transform your Amazon Brand Store from medium to high quality rating

Back to Page

Amazon Brand Store

The 97% lift: Proven tactics to transform your Amazon Brand Store from medium to high quality rating

Dec 30, 2025

TL;DR

Amazon now rates Brand Stores mainly on sales attribution, not design or dwell time, so stores that do not convert stay stuck at medium quality.

Traffic without clear buying paths leads to weak quality signals, even if sessions are high.

High-quality Brand Stores are built like funnels, with hero ASINs, best sellers, and fast paths to purchase visible above the fold.

Reducing clicks between entry and product pages directly improves conversions and Brand Store quality ratings.

Sponsored Brands ads perform better when they land on high-intent, product-focused Store pages, not generic home or category pages.

Using competing ASIN and peer performance data helps identify gaps faster and make changes that push your store into the High-quality tier.

The 97% lift is not a design trend or a branding stat. It is the difference between a Brand Store that simply gets visits and one that actively drives revenue. Amazon has made this clear by shifting how it evaluates stores. Today, your Amazon Brand Store design is judged by sales impact, not how polished your banners look.

Many sellers still believe great visuals equal high quality. That misconception keeps Stores stuck at Medium. Under the new system, Amazon treats Brand Stores as revenue drivers, not branding assets. If your store does not help shoppers decide and purchase, it sends weak quality signals.

This is why Amazon Brand Store quality and Brand Store sales impact now matter more than ever. The strategies in this guide focus on one goal: turning your Brand Store into a conversion engine that Amazon trusts, rewards, and sends more buyers to.

What is the Brand Store quality rating on Amazon?

The Brand Store quality rating is Amazon’s way of evaluating how well your Brand Store performs. It categorizes your store as high, medium, or low quality based on how effectively it supports shopper activity and sales.

Amazon uses this rating to compare your store with similar brands in your category. A higher rating means your store is doing a better job of helping shoppers discover products, navigate easily, and complete purchases.

In simple terms, the Amazon Brand Store quality rating shows whether your Brand Store is functioning as a strong shopping experience or just a page shoppers visit without taking action.

How does Amazon define Brand Store quality today?

Amazon has quietly changed how Brand Store quality is judged, and the shift is very seller focused. Earlier, success was tied to dwell time, how long shoppers stayed inside your store. Today, the core signal is sales attribution. In simple terms, Amazon now cares less about browsing and more about buying.

Your Brand Store is rated high, medium, or low based on how much revenue it drives within Amazon’s attribution window. If shoppers enter your store and complete purchases shortly after, your quality score improves. This is why Amazon Brand Store sales performance now matters more than design alone. A beautiful store that does not convert will stay stuck at Medium.

Dwell time and peer benchmarks still exist. You can see them for context, but they no longer decide your quality rating. They help explain behavior, not performance. From an SEO perspective, Amazon looks at signals that indicate intent, product discovery flow, logical category paths, and how effectively your store moves shoppers toward purchase. Strong sales attribution tells Amazon your store is relevant, helpful, and conversion ready.

Metric | Old system (pre Dec 12) | New system (post Dec 12) |

Primary focus | Dwell time, how long shoppers stayed | Sales attributed to Brand Store visits (14 day window) |

What Amazon measured | Engagement compared to peer brands | Revenue performance compared to peer brands |

Quality rating logic | Time spent vs category average | Sales driven vs category average |

Ratings shown | High, Medium, Low | High, Medium, Low |

Role of dwell time | Core ranking signal | Informational only |

Bounce rate | Not emphasized | Still visible for analysis |

New vs returning visitors | Not a key factor | Still visible for insights |

Conversion impact | Indirect | Direct and measurable |

Business outcome | Browsing focused | Purchase focused |

Sales impact | No clear upside | High quality stores see up to 97% more sales |

Why does your Brand Store get traffic but no sales?

Most Brand Stores do not fail because of low traffic. They fail because traffic does not convert. A very common pattern is high sessions coming from ads or search, but very few purchases happening inside the store. Amazon sees this clearly, which is why the store stays rated Medium.

One big reason is brand storytelling without clear purchase paths. Sellers invest heavily in banners, lifestyle images, and brand messages, but forget to guide shoppers to a product decision. A shopper lands on the homepage, scrolls, reads, clicks again, and still does not reach a product page quickly. Every extra click reduces intent.

Another issue is sending ad traffic to non-converting store pages. For example, a Sponsored Brands ad pushes traffic to a category page with six collections, long text blocks, and no featured ASINs above the fold. Shoppers browse, then leave. Amazon records the visit but sees no sale.

There is also a structural problem. Many stores have too many layers between entry and checkout. Home page → category → sub category → product grid → product page. By the time shoppers arrive, intent is gone.

From an SEO and performance view, this results in low Brand Store quality rating signals. To move the Amazon Brand Store from medium to high quality, the store must behave less like a brochure and more like a guided buying experience, where the next step is always obvious and fast.

What separates high-quality Brand Stores from the rest

Area | Medium-quality Brand Store | High-quality Amazon Brand Store |

Core mindset | Built like a catalog, focused on visuals | Built like a funnel, focused on transactions |

Definition of quality (post Dec 12, 2025) | Engagement and browsing behavior | Attributed sales within a 14-day window |

Navigation speed | Multiple layers and collection pages | Two clicks or fewer from homepage to Buy Now |

Homepage layout | Banners and brand story first | Best sellers and hero ASINs above the fold |

Product prioritization | All products treated equally | Clear focus on top converting ASINs |

Example | Shopper clicks Home → Category → Sub category → Product | Shopper clicks Home → Featured product → Buy |

Use of Amazon recommendations | Suggestions ignored or treated as optional | “Sales impact” recommendations treated as a roadmap |

Optimization approach | One-time changes based on design | Ongoing changes based on sales attribution data |

Peer benchmarking | Looks only at internal performance | Actively measures performance against peer brands |

Competitive response | Slow or reactive | Fast creative and layout pivots to protect share |

Seasonal updates | Updated once or twice a year | Updated every 45–60 days to match rolling window |

Page structure | Organized by product type | Organized by buying intent |

Intent pages | Generic categories like “All products” | Pages like “Best sellers,” “Gifts under $50,” “Top rated for 2026” |

SEO signal sent to Amazon | Brand Store not converting | High-quality Amazon Brand Store |

Bottom line | Traffic without velocity | Sales velocity that keeps the quality rating High |

The difference between Medium and High-quality Brand Stores is not how they look; it is how fast they convert. If your store does not guide shoppers smoothly to a purchase, Amazon sees it. One clear Amazon Storefront example of a high-quality store is how quickly a shopper understands what to click next, without friction or confusion. That is exactly what the next strategies are designed to fix.

How to improve the Amazon Brand Store quality rating

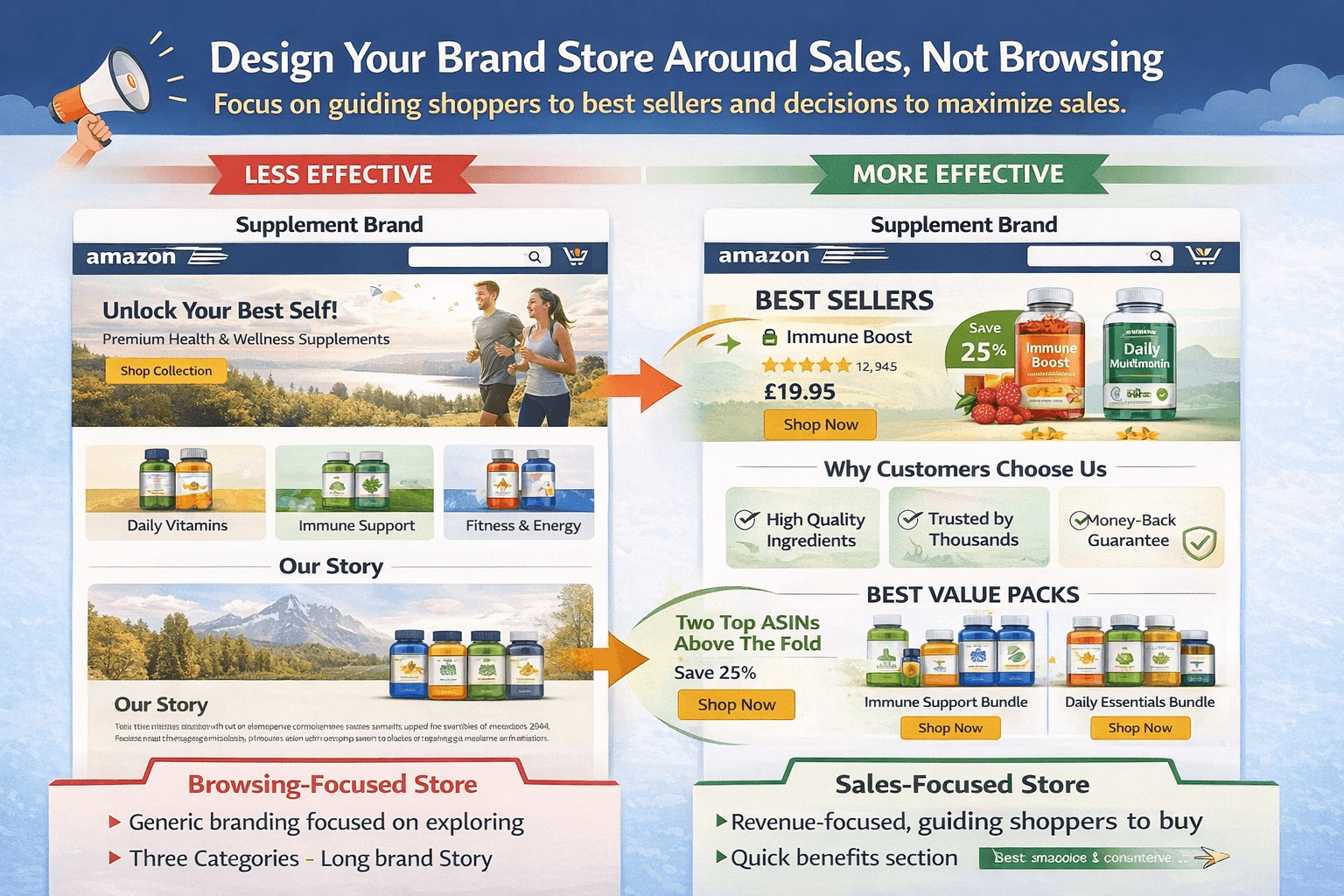

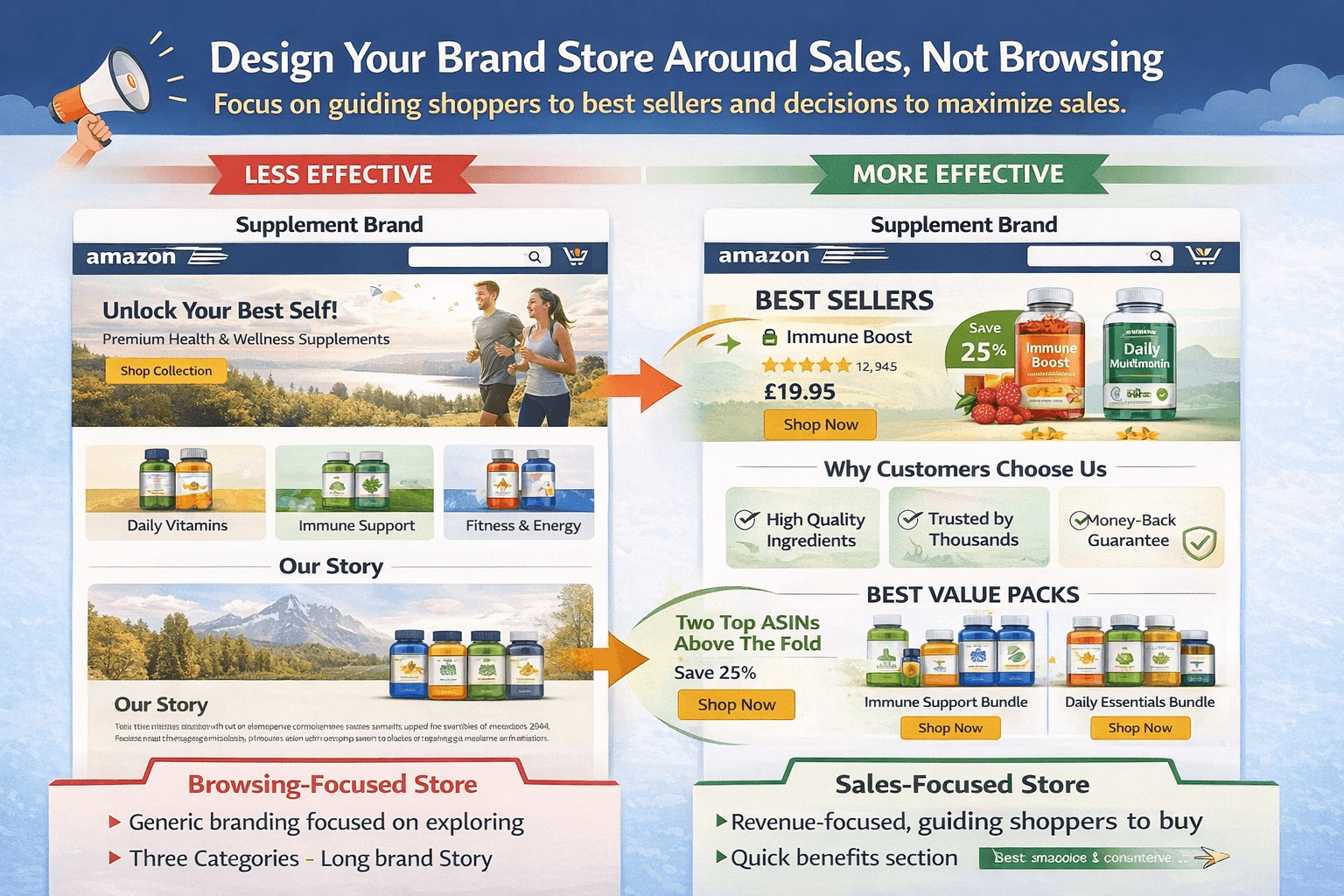

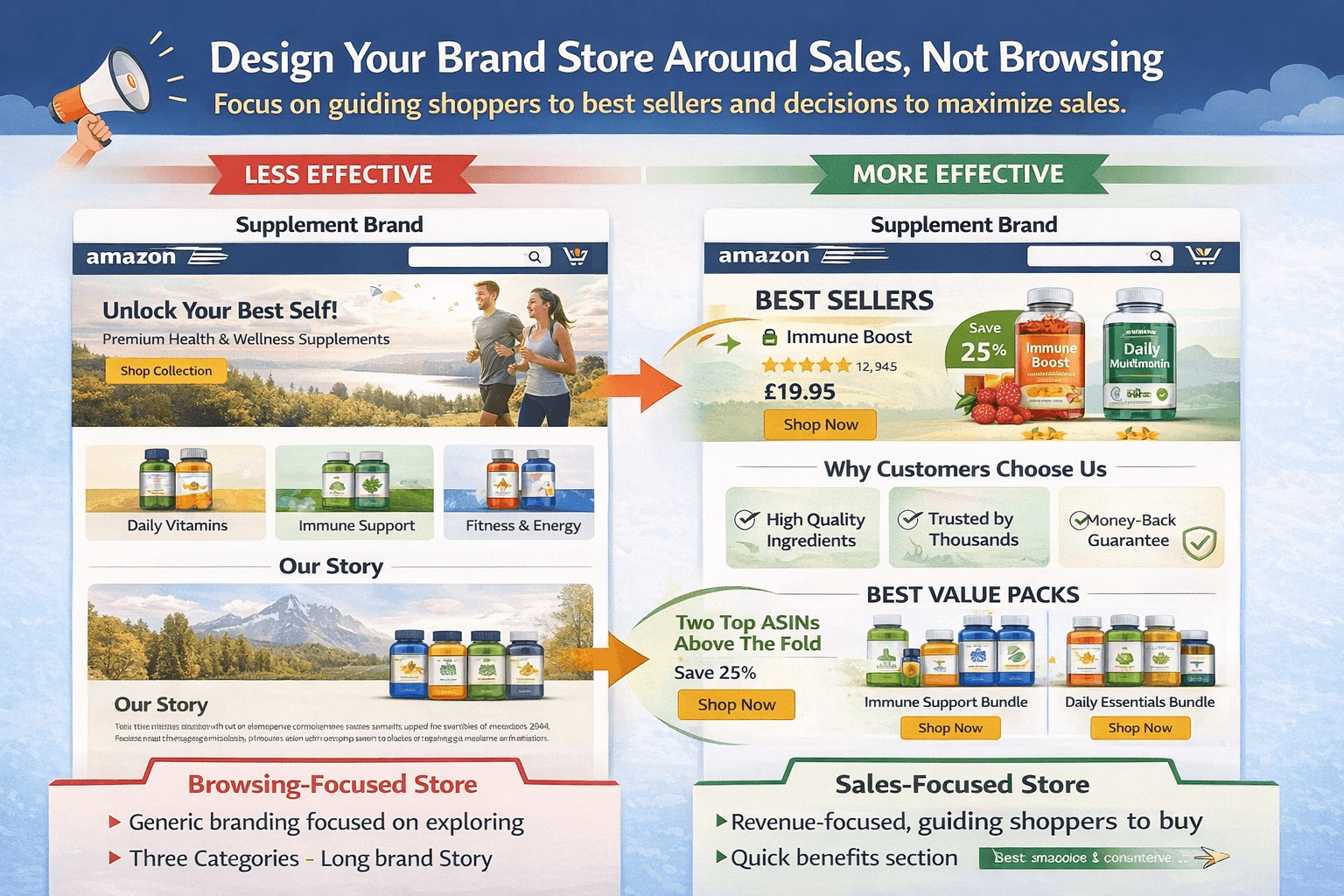

#1: Design your brand store around sales, not browsing

The fastest way to upgrade your Brand Store performance is to change what your homepage is designed to do. Most Stores are built for browsing. High-performing stores are built for decisions.

Start with your homepage hierarchy. The first screen should highlight revenue-driving ASINs, not brand banners or category lists. When shoppers land, they should immediately see your best sellers, hero products, or most trusted bundles. Fewer choices lead to clearer decisions, and clearer decisions lead to sales.

This does not mean removing visuals. It means using visuals with purpose. Every image, tile, or banner should push a shopper closer to a product page. Shoppable images, featured product grids, and short benefit-led callouts work better than long brand stories. Exploration feels nice, but buying is what Amazon measures.

Example: A supplement brand sends Sponsored Brands traffic to its store. A browsing-focused store shows a lifestyle banner, then three categories, then a long brand story. A sales-focused store shows “Best Sellers,” places the top two ASINs above the fold, and adds a quick “Why customers choose this” section. Same traffic, very different outcome.

Under the new system, Amazon Brand Store sales attribution is what drives your quality rating. When shoppers enter your store and quickly purchase, Amazon sees your store as helpful, relevant, and efficient. That is why this structure is rewarded. You are not just making it easier for shoppers; you are aligning your store with exactly how Amazon now defines quality.

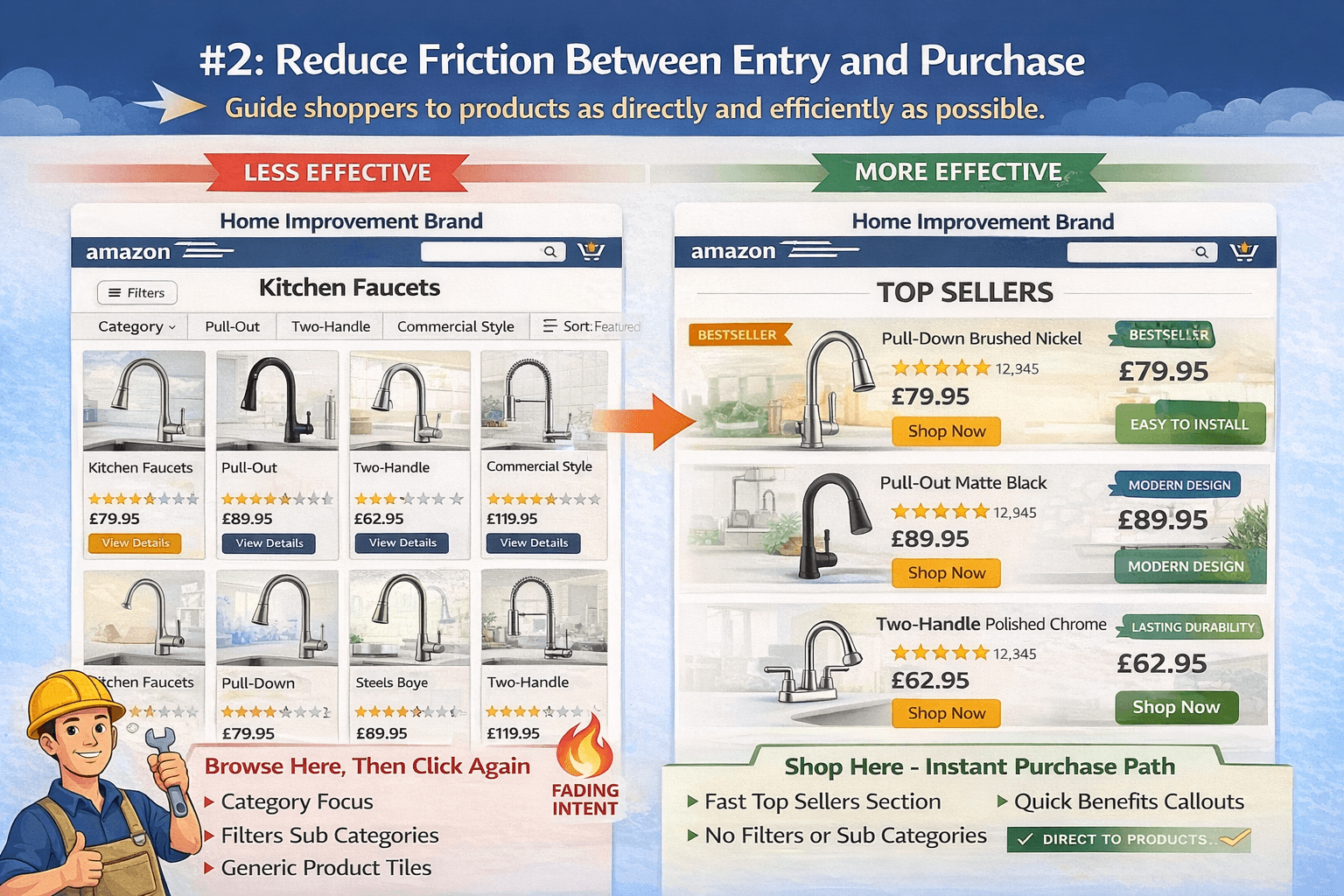

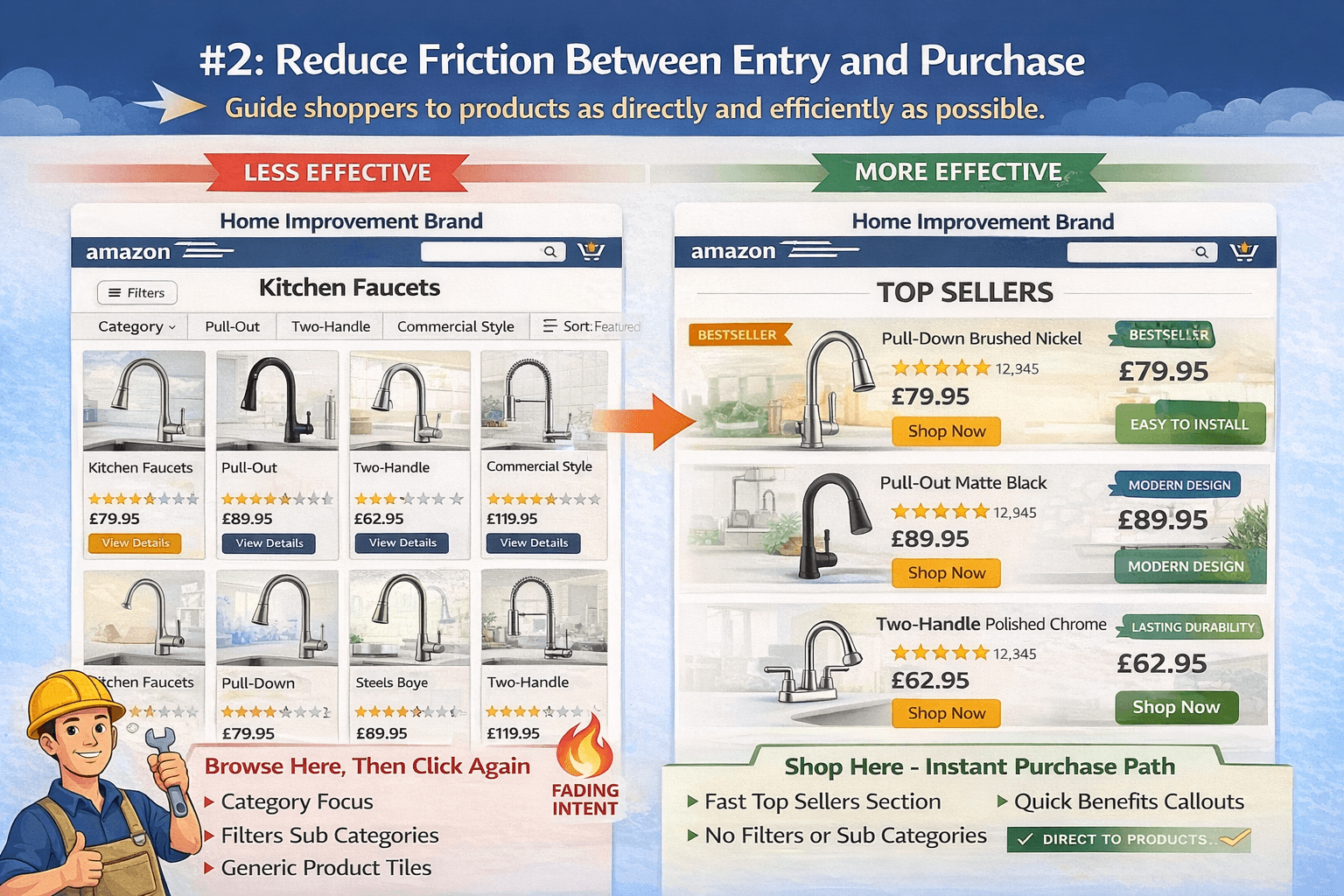

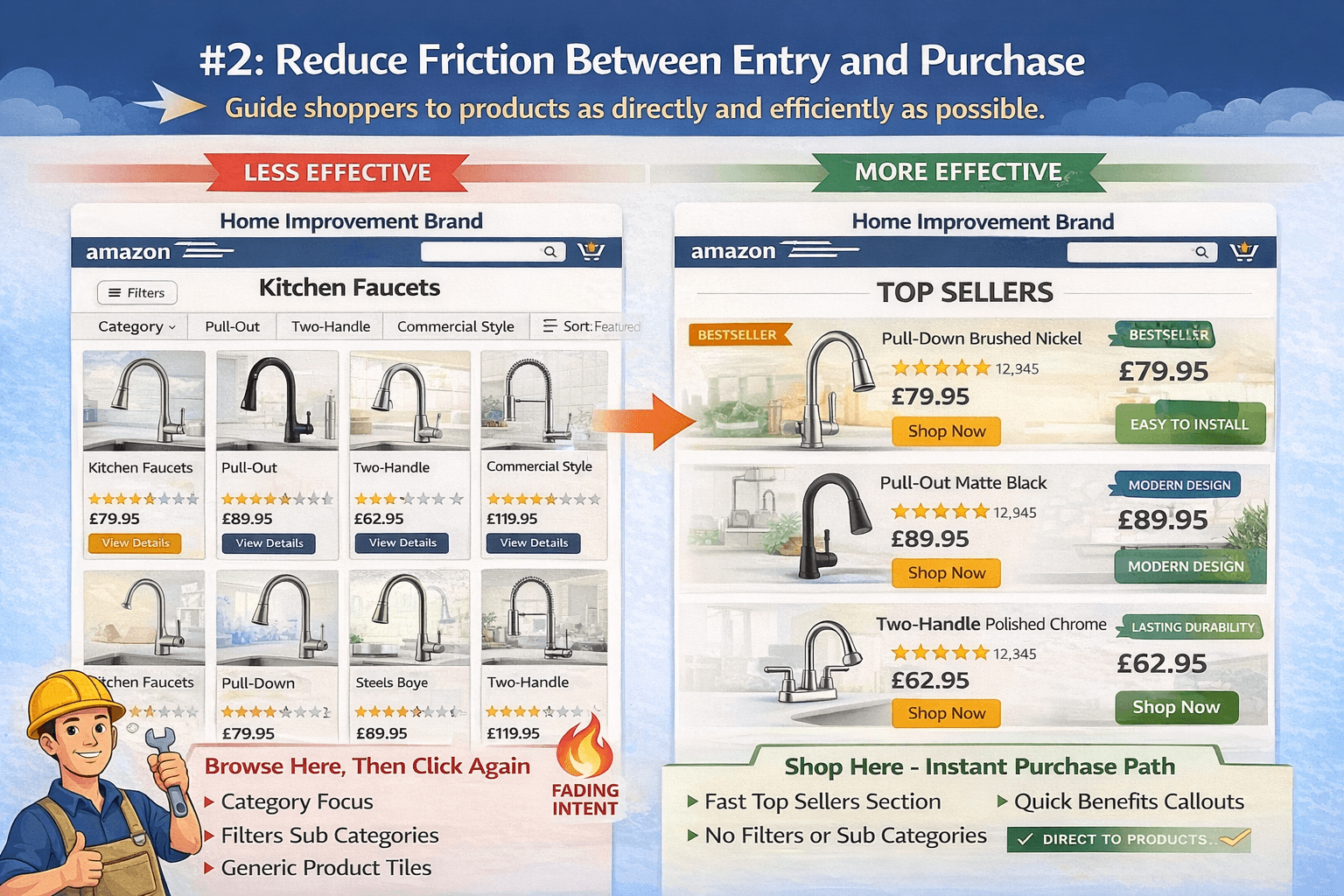

#2: Reduce friction between entry and purchase

Every extra click inside your Brand Store costs you sales. Not because shoppers are impatient, but because intent fades fast. Amazon tracks this closely, and it directly affects your quality rating.

The logic is simple. A shopper enters your store with buying intent. If they have to click through multiple categories, collections, or long content blocks before reaching a product page, the chance of conversion drops. When that happens, the visit is recorded, but the sale never arrives inside the attribution window.

This is where Amazon Brand Store conversion optimization becomes critical. Your store navigation should shorten the buying path, not extend it. Direct access to products matters more than perfect organization. Featured product grids, shoppable images, and clearly labeled best-seller sections remove friction and speed up decisions.

Example: Imagine a home improvement brand running Sponsored Brands ads. In one version, traffic lands on a category page with filters and sub categories. In another, traffic lands on a page showing the top three best-sellers with quick benefit callouts and clear product links. The second version consistently converts better, even with the same traffic quality.

Amazon’s sales attribution window rewards efficiency. When shoppers move quickly from entry to purchase, the store sends stronger performance signals. Reducing friction is not about oversimplifying your store. It is about respecting buyer intent and guiding it smoothly. The fewer obstacles you place between interest and checkout, the more Amazon recognizes your store as high quality.

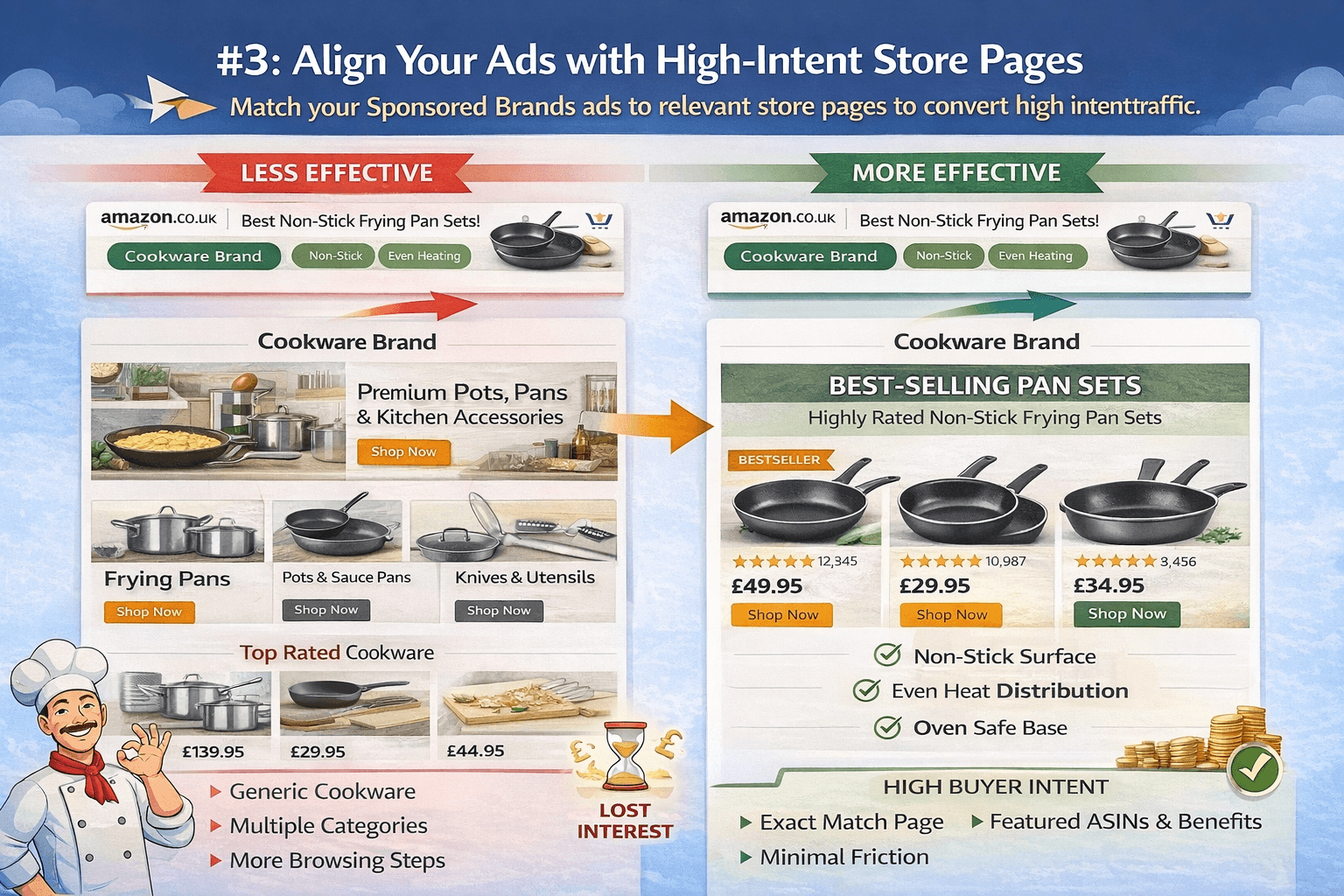

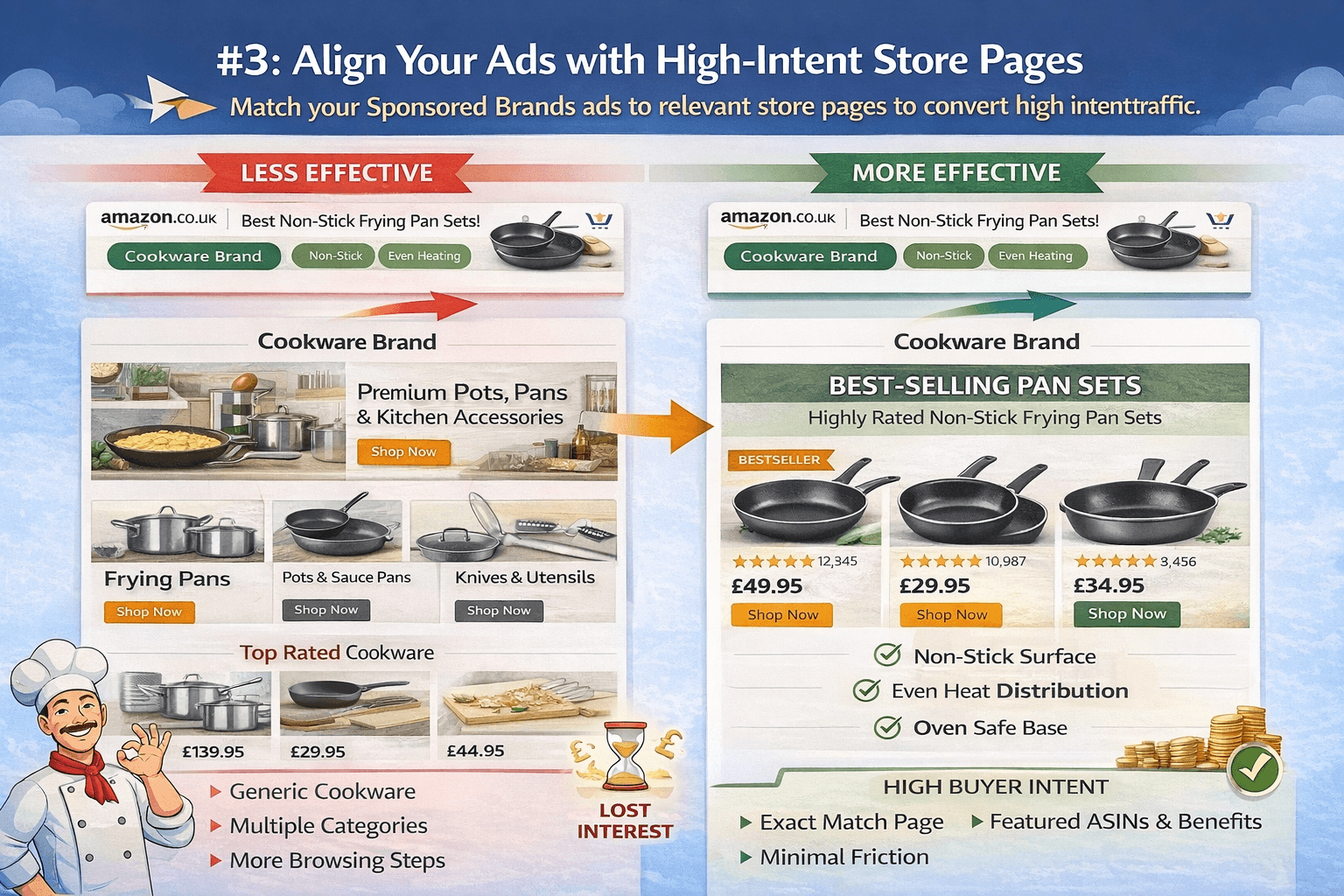

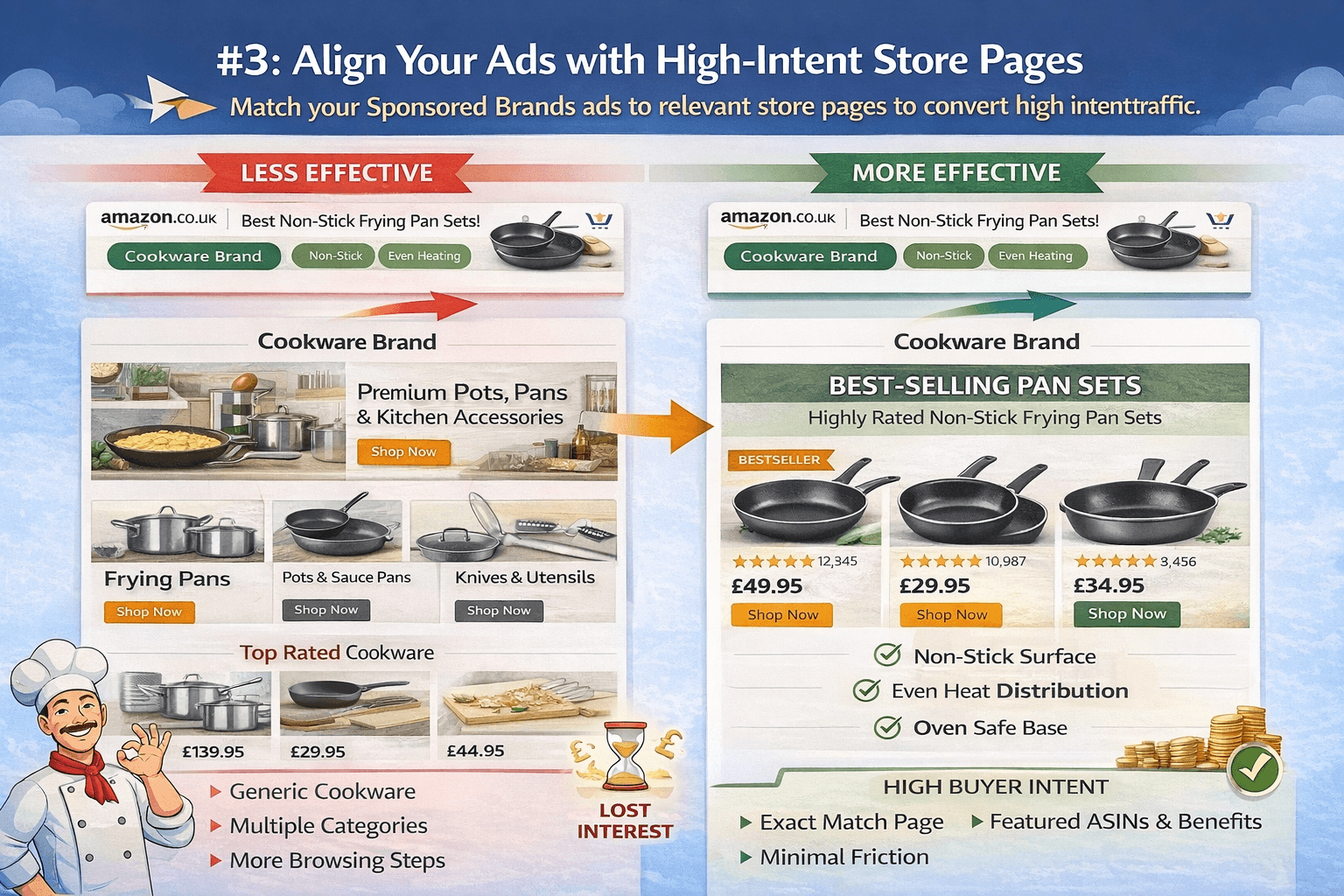

#3: Align your ads with high-intent Store pages

Running Sponsored Brands ads without aligning them to the right store pages is one of the most common reasons Brand Stores underperform. The traffic arrives, but the intent gets lost.

Sponsored Brands clicks are high-intent by nature. Shoppers are already searching, comparing, and are close to buying. When that traffic is sent to a generic homepage or a broad category page, it slows them down. Amazon still counts the visit, but if the purchase does not happen soon after, your Amazon Brand Store sales metrics take the hit.

The fix is intent matching. Your ad message and your landing page should answer the same question. If your ad highlights a best seller, the click should land on a page where that product is immediately visible and easy to buy. If the ad promotes a bundle or seasonal offer, the landing page should be built around that exact offer.

Example: A kitchen brand runs Sponsored Brands ads for “non-stick frying pan set.” Sending traffic to a general cookware page forces shoppers to browse. Sending traffic to a “Best-selling pan sets” store page with featured ASINs converts faster, without increasing ad spend.

This alignment improves attributed sales because the buying path stays short and clear. From an SEO and performance perspective, Amazon sees stronger connections between Sponsored Brands traffic and store purchases. When your ads and store sections work together, you turn the same clicks into more revenue, higher quality signals, and a Brand Store that actually supports your ad investment.

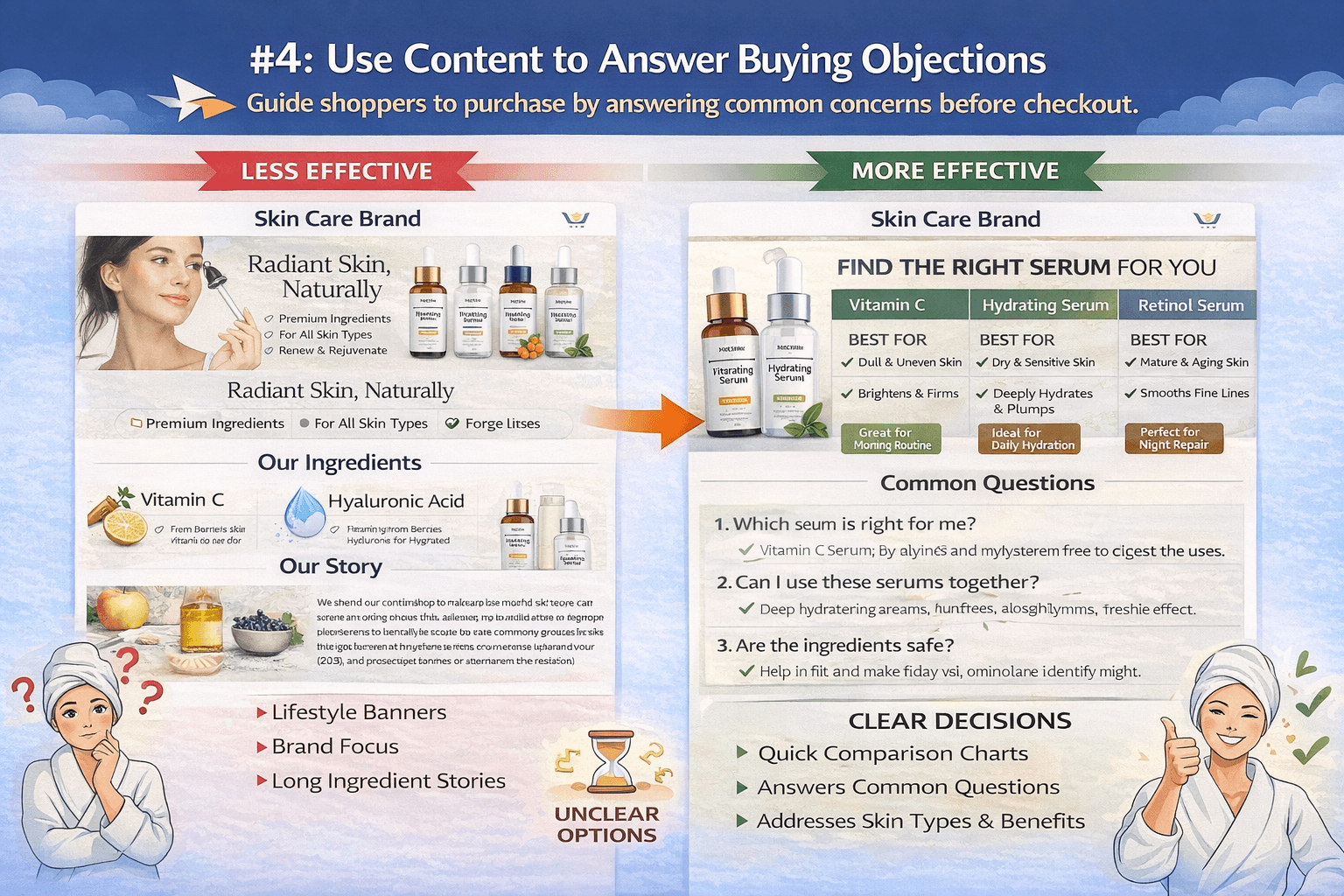

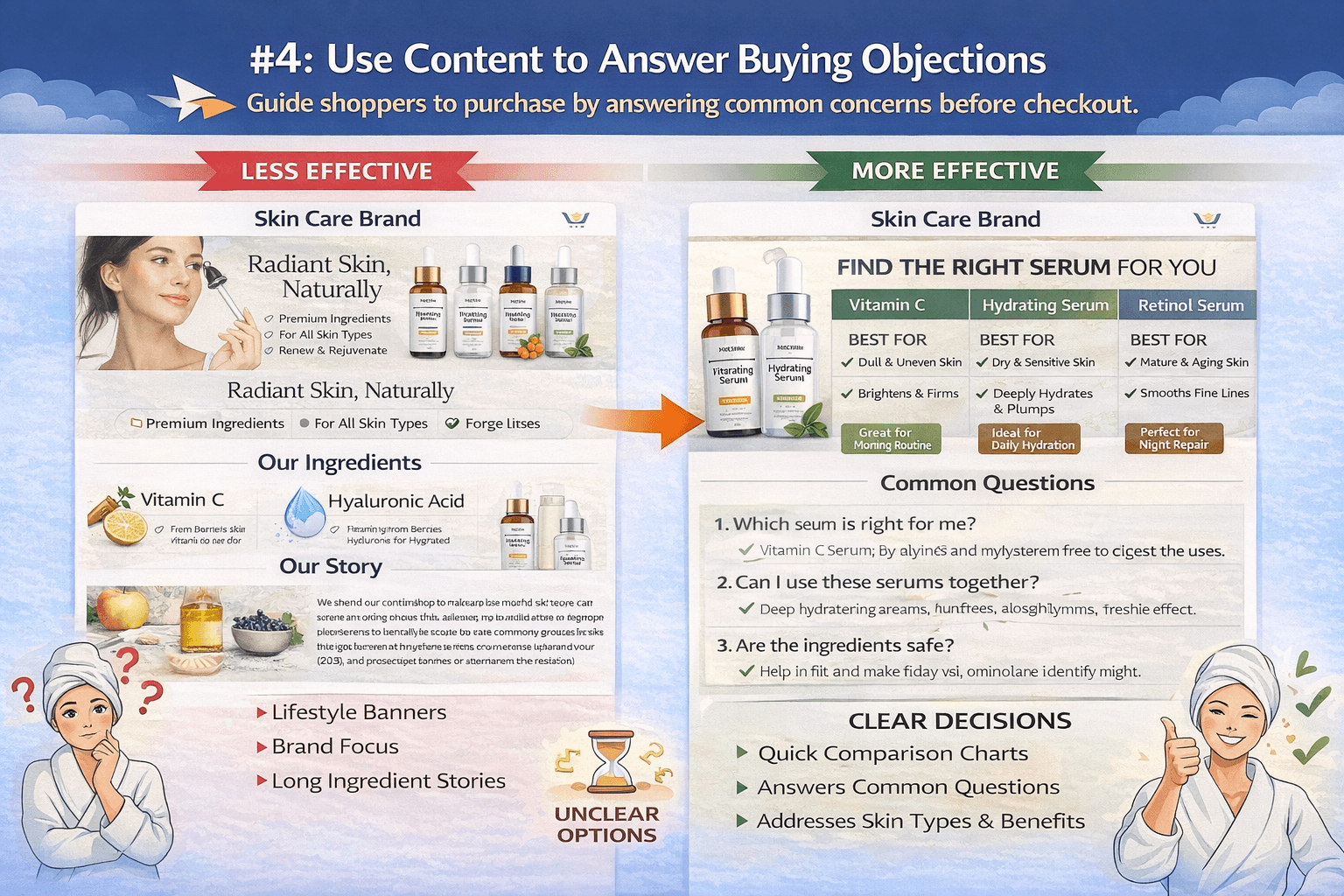

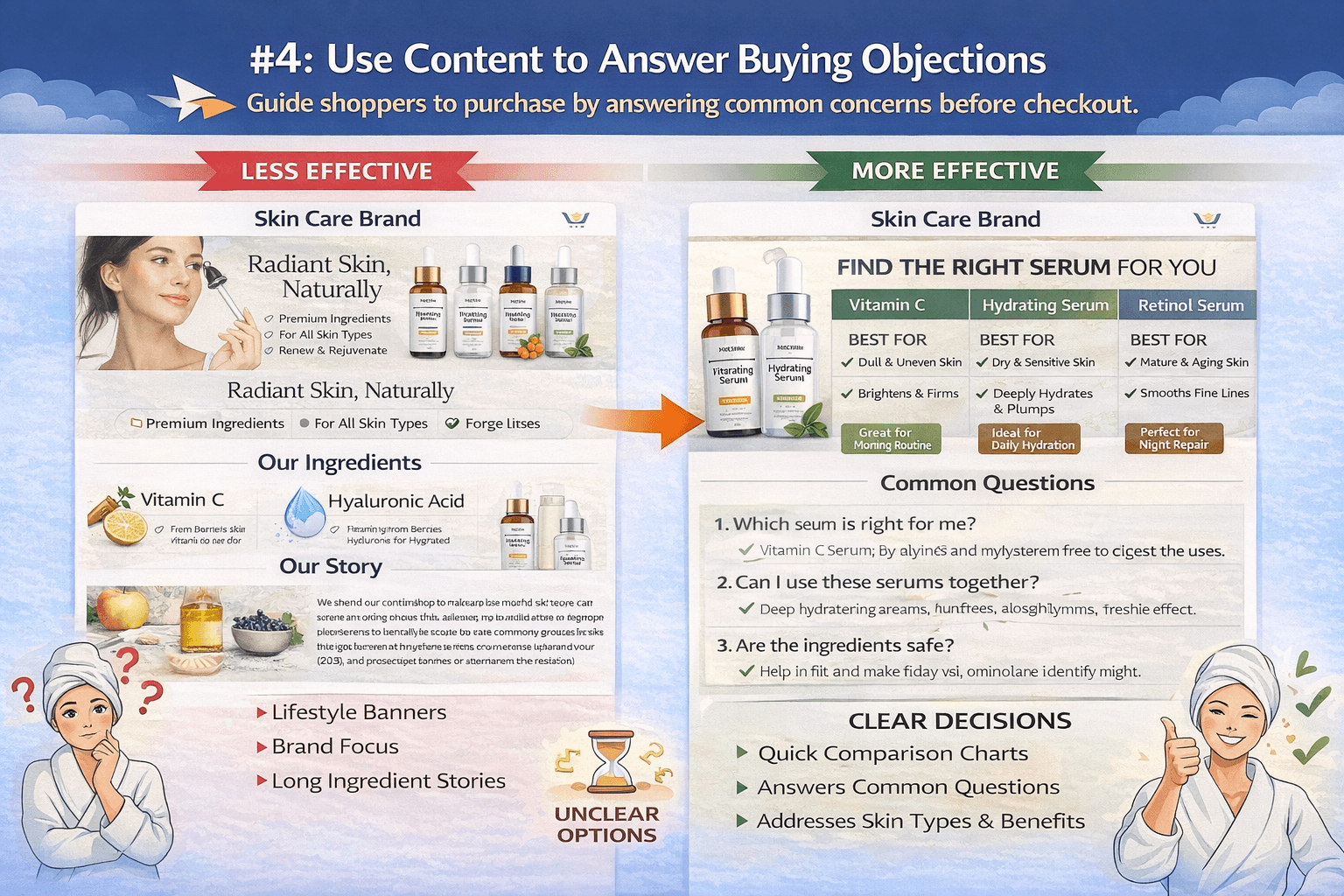

#4: Use content to answer buying objections

Most Brand Store content looks good, but does very little to help shoppers decide. High-performing stores use content differently. They focus less on brand storytelling and more on removing buying objections.

Shoppers do not enter a Brand Store to read your brand story again. They come with questions.

Is this the right product for me?

How is it different from the others?

Will it solve my problem?

Content that answers these questions speeds up decisions and builds trust. This is where comparisons, FAQs, and real use cases matter. Simple comparison charts, short “Who this is for” sections, and clear benefit callouts work far better than long lifestyle banners. When objections are handled early, shoppers feel confident moving to the product page.

Example: A skincare brand has three similar serums. A storytelling-focused store talks about ingredients and brand values. A conversion-focused store adds a comparison table showing skin type, key benefits, and best use cases. Shoppers immediately know which one to choose, and conversions increase without changing traffic.

Content placement also matters. High-quality stores surface this information before shoppers click away or scroll endlessly. Short sections placed near featured products work better than deep content pages no one reaches.

From Amazon’s perspective, faster decisions lead to higher conversion rates. Higher conversion sends stronger quality signals. When your content helps shoppers decide instead of browsing, Amazon recognizes your store as useful and efficient, which directly supports a higher Brand Store quality rating.

#5: Use competing ASIN data to spot gaps

Peer insights are no longer just a “nice to have.” Since the December 2025 update, they have been built directly into how Amazon evaluates Brand Store quality. Amazon now expects sellers to benchmark themselves against similar brands, and in 2026, this is one of the clearest paths to reaching the high-quality tier.

Peer comparison does not mean looking at the biggest brand in your category. Amazon automatically groups you with brands similar in category, sales volume, and marketplace presence. This keeps the comparison fair and focused. Metrics like peer sales over the last 60 days and peer dwell time help Amazon answer one question: Are you keeping up with best practices in your space?

If your store is rated medium, it usually means your attributed sales are close to the category average. You are not failing, but you are not winning either. If your sales are strong but your rating is still medium, it often means your store attracts traffic but converts less efficiently than its peers.

If both you and your peers are underperforming, that is an opportunity. A single strong layout change can move you ahead of the entire group.

From an SEO standpoint, Brand Store peer performance acts as a trust signal. High-converting stores are destinations Amazon is more confident sending traffic to. Sellers who treat peer data as a competitive blueprint, not a scorecard, find the gaps faster and close them before others do.

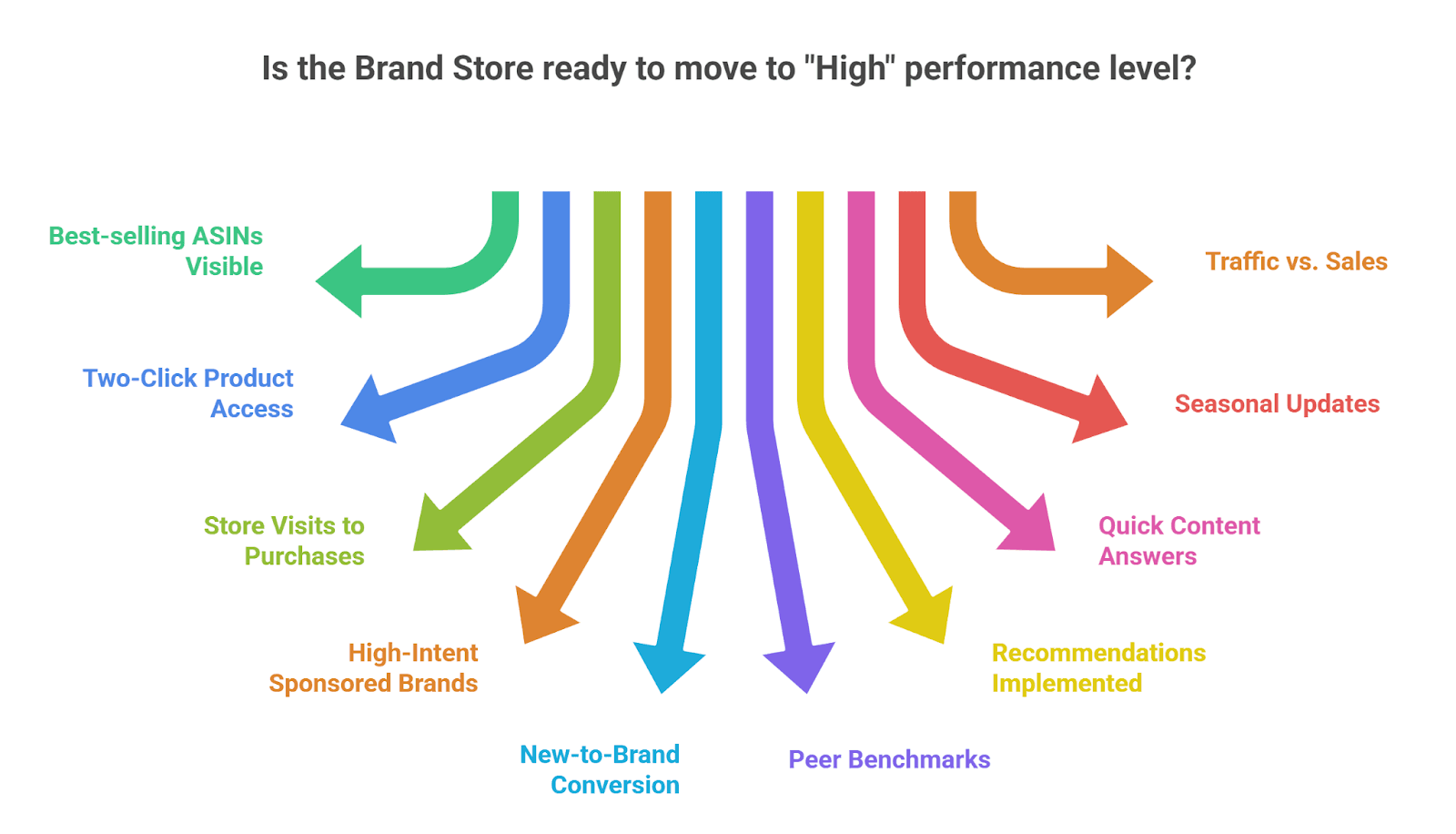

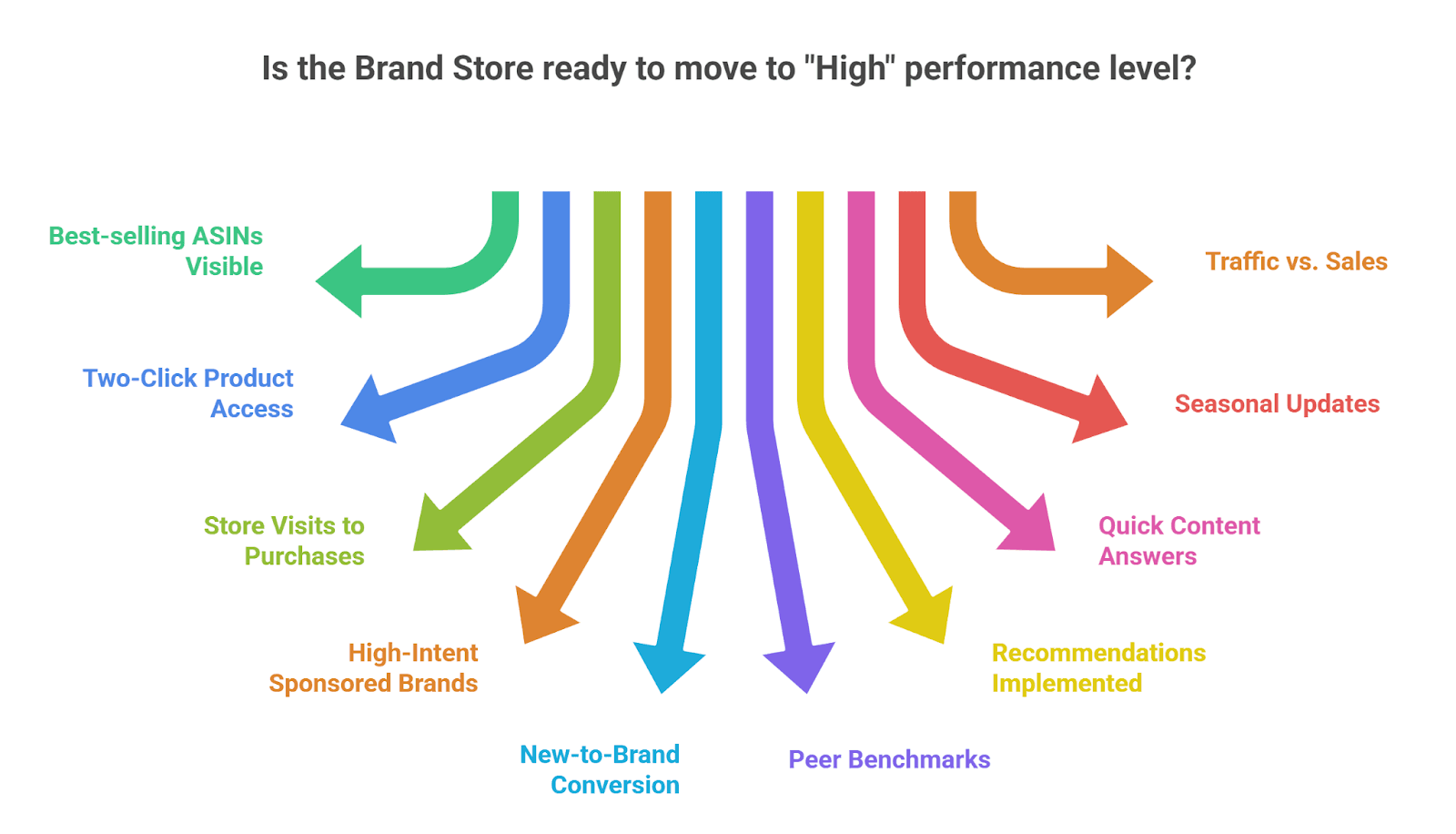

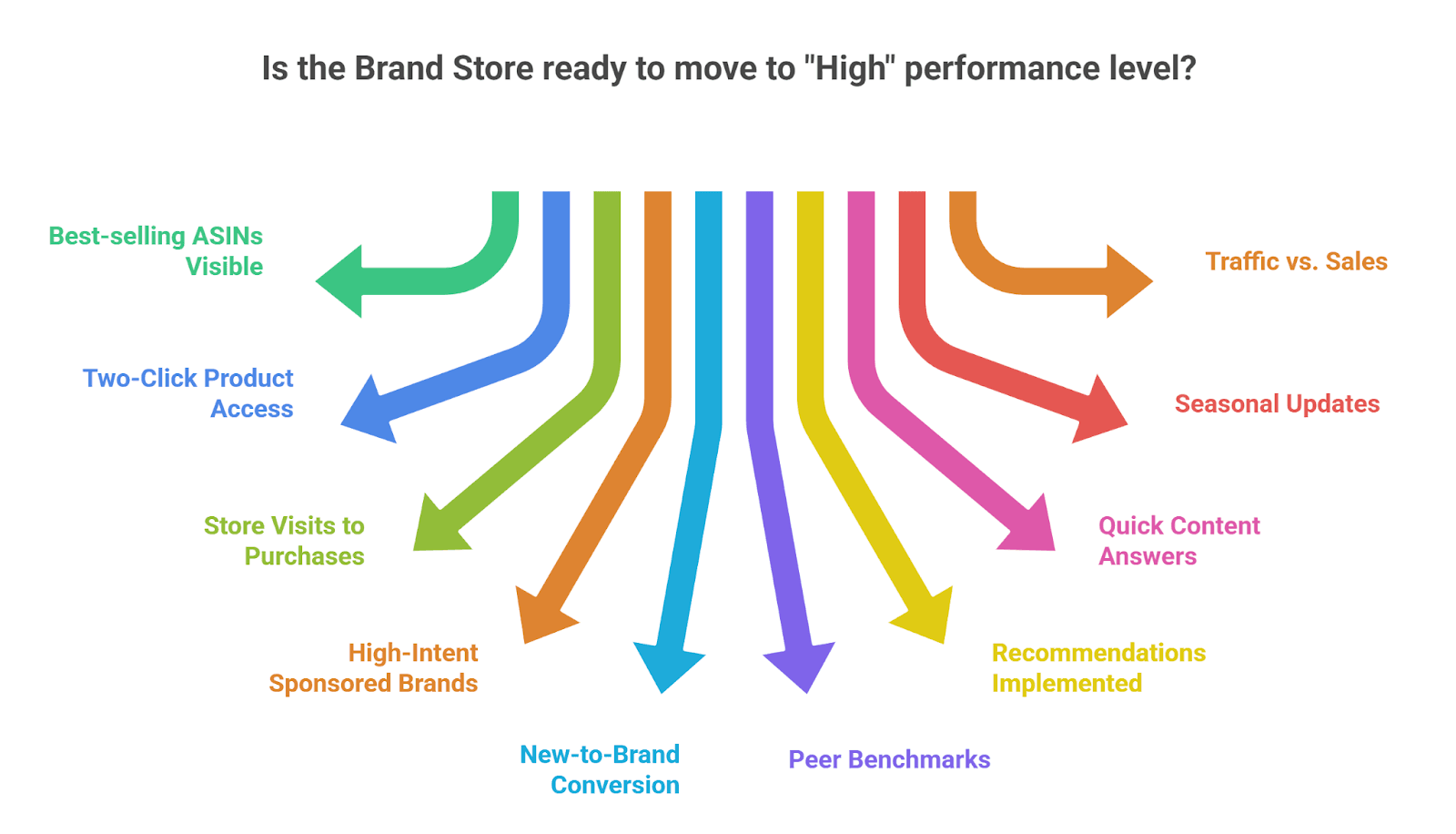

How to tell if your Brand Store is ready to move to “High”?

Final words

Moving your Amazon Brand Store from medium to high quality isn’t about prettier banners; it’s about driving sales, reducing friction, and guiding shoppers to purchase. By focusing on conversion-driven design, intent-aligned ads, content that answers buying questions, and leveraging peer insights, you can turn your store into a high-performing revenue engine.

At eStore Factory, we specialize in Amazon Brand Store optimization services, helping sellers implement these strategies effectively. From layout planning to sales attribution analysis, we ensure your store maximizes conversions and improves your quality rating.

Don’t let your traffic go to waste, and optimize your Brand Store today, and unlock the full potential of your Amazon storefront.

Reach out to the eStore Factory and start turning visits into measurable sales now.

TL;DR

Amazon now rates Brand Stores mainly on sales attribution, not design or dwell time, so stores that do not convert stay stuck at medium quality.

Traffic without clear buying paths leads to weak quality signals, even if sessions are high.

High-quality Brand Stores are built like funnels, with hero ASINs, best sellers, and fast paths to purchase visible above the fold.

Reducing clicks between entry and product pages directly improves conversions and Brand Store quality ratings.

Sponsored Brands ads perform better when they land on high-intent, product-focused Store pages, not generic home or category pages.

Using competing ASIN and peer performance data helps identify gaps faster and make changes that push your store into the High-quality tier.

The 97% lift is not a design trend or a branding stat. It is the difference between a Brand Store that simply gets visits and one that actively drives revenue. Amazon has made this clear by shifting how it evaluates stores. Today, your Amazon Brand Store design is judged by sales impact, not how polished your banners look.

Many sellers still believe great visuals equal high quality. That misconception keeps Stores stuck at Medium. Under the new system, Amazon treats Brand Stores as revenue drivers, not branding assets. If your store does not help shoppers decide and purchase, it sends weak quality signals.

This is why Amazon Brand Store quality and Brand Store sales impact now matter more than ever. The strategies in this guide focus on one goal: turning your Brand Store into a conversion engine that Amazon trusts, rewards, and sends more buyers to.

What is the Brand Store quality rating on Amazon?

The Brand Store quality rating is Amazon’s way of evaluating how well your Brand Store performs. It categorizes your store as high, medium, or low quality based on how effectively it supports shopper activity and sales.

Amazon uses this rating to compare your store with similar brands in your category. A higher rating means your store is doing a better job of helping shoppers discover products, navigate easily, and complete purchases.

In simple terms, the Amazon Brand Store quality rating shows whether your Brand Store is functioning as a strong shopping experience or just a page shoppers visit without taking action.

How does Amazon define Brand Store quality today?

Amazon has quietly changed how Brand Store quality is judged, and the shift is very seller focused. Earlier, success was tied to dwell time, how long shoppers stayed inside your store. Today, the core signal is sales attribution. In simple terms, Amazon now cares less about browsing and more about buying.

Your Brand Store is rated high, medium, or low based on how much revenue it drives within Amazon’s attribution window. If shoppers enter your store and complete purchases shortly after, your quality score improves. This is why Amazon Brand Store sales performance now matters more than design alone. A beautiful store that does not convert will stay stuck at Medium.

Dwell time and peer benchmarks still exist. You can see them for context, but they no longer decide your quality rating. They help explain behavior, not performance. From an SEO perspective, Amazon looks at signals that indicate intent, product discovery flow, logical category paths, and how effectively your store moves shoppers toward purchase. Strong sales attribution tells Amazon your store is relevant, helpful, and conversion ready.

Metric | Old system (pre Dec 12) | New system (post Dec 12) |

Primary focus | Dwell time, how long shoppers stayed | Sales attributed to Brand Store visits (14 day window) |

What Amazon measured | Engagement compared to peer brands | Revenue performance compared to peer brands |

Quality rating logic | Time spent vs category average | Sales driven vs category average |

Ratings shown | High, Medium, Low | High, Medium, Low |

Role of dwell time | Core ranking signal | Informational only |

Bounce rate | Not emphasized | Still visible for analysis |

New vs returning visitors | Not a key factor | Still visible for insights |

Conversion impact | Indirect | Direct and measurable |

Business outcome | Browsing focused | Purchase focused |

Sales impact | No clear upside | High quality stores see up to 97% more sales |

Why does your Brand Store get traffic but no sales?

Most Brand Stores do not fail because of low traffic. They fail because traffic does not convert. A very common pattern is high sessions coming from ads or search, but very few purchases happening inside the store. Amazon sees this clearly, which is why the store stays rated Medium.

One big reason is brand storytelling without clear purchase paths. Sellers invest heavily in banners, lifestyle images, and brand messages, but forget to guide shoppers to a product decision. A shopper lands on the homepage, scrolls, reads, clicks again, and still does not reach a product page quickly. Every extra click reduces intent.

Another issue is sending ad traffic to non-converting store pages. For example, a Sponsored Brands ad pushes traffic to a category page with six collections, long text blocks, and no featured ASINs above the fold. Shoppers browse, then leave. Amazon records the visit but sees no sale.

There is also a structural problem. Many stores have too many layers between entry and checkout. Home page → category → sub category → product grid → product page. By the time shoppers arrive, intent is gone.

From an SEO and performance view, this results in low Brand Store quality rating signals. To move the Amazon Brand Store from medium to high quality, the store must behave less like a brochure and more like a guided buying experience, where the next step is always obvious and fast.

What separates high-quality Brand Stores from the rest

Area | Medium-quality Brand Store | High-quality Amazon Brand Store |

Core mindset | Built like a catalog, focused on visuals | Built like a funnel, focused on transactions |

Definition of quality (post Dec 12, 2025) | Engagement and browsing behavior | Attributed sales within a 14-day window |

Navigation speed | Multiple layers and collection pages | Two clicks or fewer from homepage to Buy Now |

Homepage layout | Banners and brand story first | Best sellers and hero ASINs above the fold |

Product prioritization | All products treated equally | Clear focus on top converting ASINs |

Example | Shopper clicks Home → Category → Sub category → Product | Shopper clicks Home → Featured product → Buy |

Use of Amazon recommendations | Suggestions ignored or treated as optional | “Sales impact” recommendations treated as a roadmap |

Optimization approach | One-time changes based on design | Ongoing changes based on sales attribution data |

Peer benchmarking | Looks only at internal performance | Actively measures performance against peer brands |

Competitive response | Slow or reactive | Fast creative and layout pivots to protect share |

Seasonal updates | Updated once or twice a year | Updated every 45–60 days to match rolling window |

Page structure | Organized by product type | Organized by buying intent |

Intent pages | Generic categories like “All products” | Pages like “Best sellers,” “Gifts under $50,” “Top rated for 2026” |

SEO signal sent to Amazon | Brand Store not converting | High-quality Amazon Brand Store |

Bottom line | Traffic without velocity | Sales velocity that keeps the quality rating High |

The difference between Medium and High-quality Brand Stores is not how they look; it is how fast they convert. If your store does not guide shoppers smoothly to a purchase, Amazon sees it. One clear Amazon Storefront example of a high-quality store is how quickly a shopper understands what to click next, without friction or confusion. That is exactly what the next strategies are designed to fix.

How to improve the Amazon Brand Store quality rating

#1: Design your brand store around sales, not browsing

The fastest way to upgrade your Brand Store performance is to change what your homepage is designed to do. Most Stores are built for browsing. High-performing stores are built for decisions.

Start with your homepage hierarchy. The first screen should highlight revenue-driving ASINs, not brand banners or category lists. When shoppers land, they should immediately see your best sellers, hero products, or most trusted bundles. Fewer choices lead to clearer decisions, and clearer decisions lead to sales.

This does not mean removing visuals. It means using visuals with purpose. Every image, tile, or banner should push a shopper closer to a product page. Shoppable images, featured product grids, and short benefit-led callouts work better than long brand stories. Exploration feels nice, but buying is what Amazon measures.

Example: A supplement brand sends Sponsored Brands traffic to its store. A browsing-focused store shows a lifestyle banner, then three categories, then a long brand story. A sales-focused store shows “Best Sellers,” places the top two ASINs above the fold, and adds a quick “Why customers choose this” section. Same traffic, very different outcome.

Under the new system, Amazon Brand Store sales attribution is what drives your quality rating. When shoppers enter your store and quickly purchase, Amazon sees your store as helpful, relevant, and efficient. That is why this structure is rewarded. You are not just making it easier for shoppers; you are aligning your store with exactly how Amazon now defines quality.

#2: Reduce friction between entry and purchase

Every extra click inside your Brand Store costs you sales. Not because shoppers are impatient, but because intent fades fast. Amazon tracks this closely, and it directly affects your quality rating.

The logic is simple. A shopper enters your store with buying intent. If they have to click through multiple categories, collections, or long content blocks before reaching a product page, the chance of conversion drops. When that happens, the visit is recorded, but the sale never arrives inside the attribution window.

This is where Amazon Brand Store conversion optimization becomes critical. Your store navigation should shorten the buying path, not extend it. Direct access to products matters more than perfect organization. Featured product grids, shoppable images, and clearly labeled best-seller sections remove friction and speed up decisions.

Example: Imagine a home improvement brand running Sponsored Brands ads. In one version, traffic lands on a category page with filters and sub categories. In another, traffic lands on a page showing the top three best-sellers with quick benefit callouts and clear product links. The second version consistently converts better, even with the same traffic quality.

Amazon’s sales attribution window rewards efficiency. When shoppers move quickly from entry to purchase, the store sends stronger performance signals. Reducing friction is not about oversimplifying your store. It is about respecting buyer intent and guiding it smoothly. The fewer obstacles you place between interest and checkout, the more Amazon recognizes your store as high quality.

#3: Align your ads with high-intent Store pages

Running Sponsored Brands ads without aligning them to the right store pages is one of the most common reasons Brand Stores underperform. The traffic arrives, but the intent gets lost.

Sponsored Brands clicks are high-intent by nature. Shoppers are already searching, comparing, and are close to buying. When that traffic is sent to a generic homepage or a broad category page, it slows them down. Amazon still counts the visit, but if the purchase does not happen soon after, your Amazon Brand Store sales metrics take the hit.

The fix is intent matching. Your ad message and your landing page should answer the same question. If your ad highlights a best seller, the click should land on a page where that product is immediately visible and easy to buy. If the ad promotes a bundle or seasonal offer, the landing page should be built around that exact offer.

Example: A kitchen brand runs Sponsored Brands ads for “non-stick frying pan set.” Sending traffic to a general cookware page forces shoppers to browse. Sending traffic to a “Best-selling pan sets” store page with featured ASINs converts faster, without increasing ad spend.

This alignment improves attributed sales because the buying path stays short and clear. From an SEO and performance perspective, Amazon sees stronger connections between Sponsored Brands traffic and store purchases. When your ads and store sections work together, you turn the same clicks into more revenue, higher quality signals, and a Brand Store that actually supports your ad investment.

#4: Use content to answer buying objections

Most Brand Store content looks good, but does very little to help shoppers decide. High-performing stores use content differently. They focus less on brand storytelling and more on removing buying objections.

Shoppers do not enter a Brand Store to read your brand story again. They come with questions.

Is this the right product for me?

How is it different from the others?

Will it solve my problem?

Content that answers these questions speeds up decisions and builds trust. This is where comparisons, FAQs, and real use cases matter. Simple comparison charts, short “Who this is for” sections, and clear benefit callouts work far better than long lifestyle banners. When objections are handled early, shoppers feel confident moving to the product page.

Example: A skincare brand has three similar serums. A storytelling-focused store talks about ingredients and brand values. A conversion-focused store adds a comparison table showing skin type, key benefits, and best use cases. Shoppers immediately know which one to choose, and conversions increase without changing traffic.

Content placement also matters. High-quality stores surface this information before shoppers click away or scroll endlessly. Short sections placed near featured products work better than deep content pages no one reaches.

From Amazon’s perspective, faster decisions lead to higher conversion rates. Higher conversion sends stronger quality signals. When your content helps shoppers decide instead of browsing, Amazon recognizes your store as useful and efficient, which directly supports a higher Brand Store quality rating.

#5: Use competing ASIN data to spot gaps

Peer insights are no longer just a “nice to have.” Since the December 2025 update, they have been built directly into how Amazon evaluates Brand Store quality. Amazon now expects sellers to benchmark themselves against similar brands, and in 2026, this is one of the clearest paths to reaching the high-quality tier.

Peer comparison does not mean looking at the biggest brand in your category. Amazon automatically groups you with brands similar in category, sales volume, and marketplace presence. This keeps the comparison fair and focused. Metrics like peer sales over the last 60 days and peer dwell time help Amazon answer one question: Are you keeping up with best practices in your space?

If your store is rated medium, it usually means your attributed sales are close to the category average. You are not failing, but you are not winning either. If your sales are strong but your rating is still medium, it often means your store attracts traffic but converts less efficiently than its peers.

If both you and your peers are underperforming, that is an opportunity. A single strong layout change can move you ahead of the entire group.

From an SEO standpoint, Brand Store peer performance acts as a trust signal. High-converting stores are destinations Amazon is more confident sending traffic to. Sellers who treat peer data as a competitive blueprint, not a scorecard, find the gaps faster and close them before others do.

How to tell if your Brand Store is ready to move to “High”?

Final words

Moving your Amazon Brand Store from medium to high quality isn’t about prettier banners; it’s about driving sales, reducing friction, and guiding shoppers to purchase. By focusing on conversion-driven design, intent-aligned ads, content that answers buying questions, and leveraging peer insights, you can turn your store into a high-performing revenue engine.

At eStore Factory, we specialize in Amazon Brand Store optimization services, helping sellers implement these strategies effectively. From layout planning to sales attribution analysis, we ensure your store maximizes conversions and improves your quality rating.

Don’t let your traffic go to waste, and optimize your Brand Store today, and unlock the full potential of your Amazon storefront.

Reach out to the eStore Factory and start turning visits into measurable sales now.

TL;DR

Amazon now rates Brand Stores mainly on sales attribution, not design or dwell time, so stores that do not convert stay stuck at medium quality.

Traffic without clear buying paths leads to weak quality signals, even if sessions are high.

High-quality Brand Stores are built like funnels, with hero ASINs, best sellers, and fast paths to purchase visible above the fold.

Reducing clicks between entry and product pages directly improves conversions and Brand Store quality ratings.

Sponsored Brands ads perform better when they land on high-intent, product-focused Store pages, not generic home or category pages.

Using competing ASIN and peer performance data helps identify gaps faster and make changes that push your store into the High-quality tier.

The 97% lift is not a design trend or a branding stat. It is the difference between a Brand Store that simply gets visits and one that actively drives revenue. Amazon has made this clear by shifting how it evaluates stores. Today, your Amazon Brand Store design is judged by sales impact, not how polished your banners look.

Many sellers still believe great visuals equal high quality. That misconception keeps Stores stuck at Medium. Under the new system, Amazon treats Brand Stores as revenue drivers, not branding assets. If your store does not help shoppers decide and purchase, it sends weak quality signals.

This is why Amazon Brand Store quality and Brand Store sales impact now matter more than ever. The strategies in this guide focus on one goal: turning your Brand Store into a conversion engine that Amazon trusts, rewards, and sends more buyers to.

What is the Brand Store quality rating on Amazon?

The Brand Store quality rating is Amazon’s way of evaluating how well your Brand Store performs. It categorizes your store as high, medium, or low quality based on how effectively it supports shopper activity and sales.

Amazon uses this rating to compare your store with similar brands in your category. A higher rating means your store is doing a better job of helping shoppers discover products, navigate easily, and complete purchases.

In simple terms, the Amazon Brand Store quality rating shows whether your Brand Store is functioning as a strong shopping experience or just a page shoppers visit without taking action.

How does Amazon define Brand Store quality today?

Amazon has quietly changed how Brand Store quality is judged, and the shift is very seller focused. Earlier, success was tied to dwell time, how long shoppers stayed inside your store. Today, the core signal is sales attribution. In simple terms, Amazon now cares less about browsing and more about buying.

Your Brand Store is rated high, medium, or low based on how much revenue it drives within Amazon’s attribution window. If shoppers enter your store and complete purchases shortly after, your quality score improves. This is why Amazon Brand Store sales performance now matters more than design alone. A beautiful store that does not convert will stay stuck at Medium.

Dwell time and peer benchmarks still exist. You can see them for context, but they no longer decide your quality rating. They help explain behavior, not performance. From an SEO perspective, Amazon looks at signals that indicate intent, product discovery flow, logical category paths, and how effectively your store moves shoppers toward purchase. Strong sales attribution tells Amazon your store is relevant, helpful, and conversion ready.

Metric | Old system (pre Dec 12) | New system (post Dec 12) |

Primary focus | Dwell time, how long shoppers stayed | Sales attributed to Brand Store visits (14 day window) |

What Amazon measured | Engagement compared to peer brands | Revenue performance compared to peer brands |

Quality rating logic | Time spent vs category average | Sales driven vs category average |

Ratings shown | High, Medium, Low | High, Medium, Low |

Role of dwell time | Core ranking signal | Informational only |

Bounce rate | Not emphasized | Still visible for analysis |

New vs returning visitors | Not a key factor | Still visible for insights |

Conversion impact | Indirect | Direct and measurable |

Business outcome | Browsing focused | Purchase focused |

Sales impact | No clear upside | High quality stores see up to 97% more sales |

Why does your Brand Store get traffic but no sales?

Most Brand Stores do not fail because of low traffic. They fail because traffic does not convert. A very common pattern is high sessions coming from ads or search, but very few purchases happening inside the store. Amazon sees this clearly, which is why the store stays rated Medium.

One big reason is brand storytelling without clear purchase paths. Sellers invest heavily in banners, lifestyle images, and brand messages, but forget to guide shoppers to a product decision. A shopper lands on the homepage, scrolls, reads, clicks again, and still does not reach a product page quickly. Every extra click reduces intent.

Another issue is sending ad traffic to non-converting store pages. For example, a Sponsored Brands ad pushes traffic to a category page with six collections, long text blocks, and no featured ASINs above the fold. Shoppers browse, then leave. Amazon records the visit but sees no sale.

There is also a structural problem. Many stores have too many layers between entry and checkout. Home page → category → sub category → product grid → product page. By the time shoppers arrive, intent is gone.

From an SEO and performance view, this results in low Brand Store quality rating signals. To move the Amazon Brand Store from medium to high quality, the store must behave less like a brochure and more like a guided buying experience, where the next step is always obvious and fast.

What separates high-quality Brand Stores from the rest

Area | Medium-quality Brand Store | High-quality Amazon Brand Store |

Core mindset | Built like a catalog, focused on visuals | Built like a funnel, focused on transactions |

Definition of quality (post Dec 12, 2025) | Engagement and browsing behavior | Attributed sales within a 14-day window |

Navigation speed | Multiple layers and collection pages | Two clicks or fewer from homepage to Buy Now |

Homepage layout | Banners and brand story first | Best sellers and hero ASINs above the fold |

Product prioritization | All products treated equally | Clear focus on top converting ASINs |

Example | Shopper clicks Home → Category → Sub category → Product | Shopper clicks Home → Featured product → Buy |

Use of Amazon recommendations | Suggestions ignored or treated as optional | “Sales impact” recommendations treated as a roadmap |

Optimization approach | One-time changes based on design | Ongoing changes based on sales attribution data |

Peer benchmarking | Looks only at internal performance | Actively measures performance against peer brands |

Competitive response | Slow or reactive | Fast creative and layout pivots to protect share |

Seasonal updates | Updated once or twice a year | Updated every 45–60 days to match rolling window |

Page structure | Organized by product type | Organized by buying intent |

Intent pages | Generic categories like “All products” | Pages like “Best sellers,” “Gifts under $50,” “Top rated for 2026” |

SEO signal sent to Amazon | Brand Store not converting | High-quality Amazon Brand Store |

Bottom line | Traffic without velocity | Sales velocity that keeps the quality rating High |

The difference between Medium and High-quality Brand Stores is not how they look; it is how fast they convert. If your store does not guide shoppers smoothly to a purchase, Amazon sees it. One clear Amazon Storefront example of a high-quality store is how quickly a shopper understands what to click next, without friction or confusion. That is exactly what the next strategies are designed to fix.

How to improve the Amazon Brand Store quality rating

#1: Design your brand store around sales, not browsing

The fastest way to upgrade your Brand Store performance is to change what your homepage is designed to do. Most Stores are built for browsing. High-performing stores are built for decisions.

Start with your homepage hierarchy. The first screen should highlight revenue-driving ASINs, not brand banners or category lists. When shoppers land, they should immediately see your best sellers, hero products, or most trusted bundles. Fewer choices lead to clearer decisions, and clearer decisions lead to sales.

This does not mean removing visuals. It means using visuals with purpose. Every image, tile, or banner should push a shopper closer to a product page. Shoppable images, featured product grids, and short benefit-led callouts work better than long brand stories. Exploration feels nice, but buying is what Amazon measures.

Example: A supplement brand sends Sponsored Brands traffic to its store. A browsing-focused store shows a lifestyle banner, then three categories, then a long brand story. A sales-focused store shows “Best Sellers,” places the top two ASINs above the fold, and adds a quick “Why customers choose this” section. Same traffic, very different outcome.

Under the new system, Amazon Brand Store sales attribution is what drives your quality rating. When shoppers enter your store and quickly purchase, Amazon sees your store as helpful, relevant, and efficient. That is why this structure is rewarded. You are not just making it easier for shoppers; you are aligning your store with exactly how Amazon now defines quality.

#2: Reduce friction between entry and purchase

Every extra click inside your Brand Store costs you sales. Not because shoppers are impatient, but because intent fades fast. Amazon tracks this closely, and it directly affects your quality rating.

The logic is simple. A shopper enters your store with buying intent. If they have to click through multiple categories, collections, or long content blocks before reaching a product page, the chance of conversion drops. When that happens, the visit is recorded, but the sale never arrives inside the attribution window.

This is where Amazon Brand Store conversion optimization becomes critical. Your store navigation should shorten the buying path, not extend it. Direct access to products matters more than perfect organization. Featured product grids, shoppable images, and clearly labeled best-seller sections remove friction and speed up decisions.

Example: Imagine a home improvement brand running Sponsored Brands ads. In one version, traffic lands on a category page with filters and sub categories. In another, traffic lands on a page showing the top three best-sellers with quick benefit callouts and clear product links. The second version consistently converts better, even with the same traffic quality.

Amazon’s sales attribution window rewards efficiency. When shoppers move quickly from entry to purchase, the store sends stronger performance signals. Reducing friction is not about oversimplifying your store. It is about respecting buyer intent and guiding it smoothly. The fewer obstacles you place between interest and checkout, the more Amazon recognizes your store as high quality.

#3: Align your ads with high-intent Store pages

Running Sponsored Brands ads without aligning them to the right store pages is one of the most common reasons Brand Stores underperform. The traffic arrives, but the intent gets lost.

Sponsored Brands clicks are high-intent by nature. Shoppers are already searching, comparing, and are close to buying. When that traffic is sent to a generic homepage or a broad category page, it slows them down. Amazon still counts the visit, but if the purchase does not happen soon after, your Amazon Brand Store sales metrics take the hit.

The fix is intent matching. Your ad message and your landing page should answer the same question. If your ad highlights a best seller, the click should land on a page where that product is immediately visible and easy to buy. If the ad promotes a bundle or seasonal offer, the landing page should be built around that exact offer.

Example: A kitchen brand runs Sponsored Brands ads for “non-stick frying pan set.” Sending traffic to a general cookware page forces shoppers to browse. Sending traffic to a “Best-selling pan sets” store page with featured ASINs converts faster, without increasing ad spend.

This alignment improves attributed sales because the buying path stays short and clear. From an SEO and performance perspective, Amazon sees stronger connections between Sponsored Brands traffic and store purchases. When your ads and store sections work together, you turn the same clicks into more revenue, higher quality signals, and a Brand Store that actually supports your ad investment.

#4: Use content to answer buying objections

Most Brand Store content looks good, but does very little to help shoppers decide. High-performing stores use content differently. They focus less on brand storytelling and more on removing buying objections.

Shoppers do not enter a Brand Store to read your brand story again. They come with questions.

Is this the right product for me?

How is it different from the others?

Will it solve my problem?

Content that answers these questions speeds up decisions and builds trust. This is where comparisons, FAQs, and real use cases matter. Simple comparison charts, short “Who this is for” sections, and clear benefit callouts work far better than long lifestyle banners. When objections are handled early, shoppers feel confident moving to the product page.

Example: A skincare brand has three similar serums. A storytelling-focused store talks about ingredients and brand values. A conversion-focused store adds a comparison table showing skin type, key benefits, and best use cases. Shoppers immediately know which one to choose, and conversions increase without changing traffic.

Content placement also matters. High-quality stores surface this information before shoppers click away or scroll endlessly. Short sections placed near featured products work better than deep content pages no one reaches.

From Amazon’s perspective, faster decisions lead to higher conversion rates. Higher conversion sends stronger quality signals. When your content helps shoppers decide instead of browsing, Amazon recognizes your store as useful and efficient, which directly supports a higher Brand Store quality rating.

#5: Use competing ASIN data to spot gaps

Peer insights are no longer just a “nice to have.” Since the December 2025 update, they have been built directly into how Amazon evaluates Brand Store quality. Amazon now expects sellers to benchmark themselves against similar brands, and in 2026, this is one of the clearest paths to reaching the high-quality tier.

Peer comparison does not mean looking at the biggest brand in your category. Amazon automatically groups you with brands similar in category, sales volume, and marketplace presence. This keeps the comparison fair and focused. Metrics like peer sales over the last 60 days and peer dwell time help Amazon answer one question: Are you keeping up with best practices in your space?

If your store is rated medium, it usually means your attributed sales are close to the category average. You are not failing, but you are not winning either. If your sales are strong but your rating is still medium, it often means your store attracts traffic but converts less efficiently than its peers.

If both you and your peers are underperforming, that is an opportunity. A single strong layout change can move you ahead of the entire group.

From an SEO standpoint, Brand Store peer performance acts as a trust signal. High-converting stores are destinations Amazon is more confident sending traffic to. Sellers who treat peer data as a competitive blueprint, not a scorecard, find the gaps faster and close them before others do.

How to tell if your Brand Store is ready to move to “High”?

Final words

Moving your Amazon Brand Store from medium to high quality isn’t about prettier banners; it’s about driving sales, reducing friction, and guiding shoppers to purchase. By focusing on conversion-driven design, intent-aligned ads, content that answers buying questions, and leveraging peer insights, you can turn your store into a high-performing revenue engine.

At eStore Factory, we specialize in Amazon Brand Store optimization services, helping sellers implement these strategies effectively. From layout planning to sales attribution analysis, we ensure your store maximizes conversions and improves your quality rating.

Don’t let your traffic go to waste, and optimize your Brand Store today, and unlock the full potential of your Amazon storefront.

Reach out to the eStore Factory and start turning visits into measurable sales now.